Pentallect has comprehensively assessed the 2022 sales and profit performance of 70 publicly traded food companies (almost all of which are $1+ billion) that operate in all major industry sectors – food and beverage (non-alcoholic and alcoholic) manufacturers, nonfood manufacturers, grocery wholesalers and foodservice distributors, supermarket chains, foodservice management firms, and restaurant chains (quick service and full service). Our assessment focused on trends in sales, gross profit, operating expenses and operating profit. We have used simple (unweighted) averages to avoid having very large companies “distort” the results.

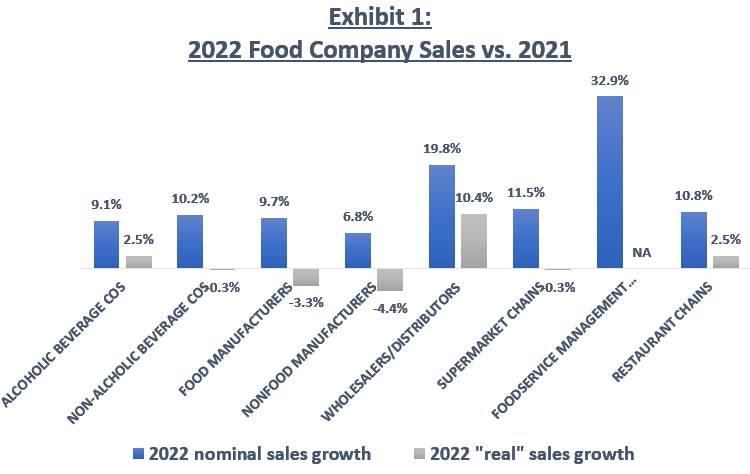

Food companies achieved solid sales growth in 2022 (the “all sector” average was +13.8%) – 68 of the 70 studied companies (97%) had sales increases, paced by the 32.9% increase experienced by the foodservice management firm sector (due to the strong recovery of its underlying institutional client base). Diageo, Lamb Weston, Performance Food Group, Chefs’ Warehouse, Aramark, Compass Group, Sodexo and Wingstop each had sales growth of 20% or greater. However, on average, all the growth was due to price increases (in some cases, arguably overly aggressive price increases); acquisitions played a very minor role. Food and nonfood manufacturers and supermarket chains experienced actual organic volume declines. Other than the foodservice management firm sector1, all but one food company’s 2022 sales are ahead of pre-Covid (2019) levels.

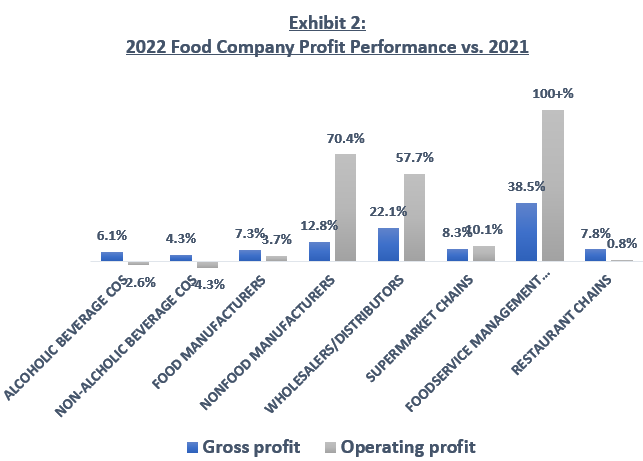

Despite ongoing supply chain and cost pressures, food company profitability trends were generally favorable with all sectors experiencing modest increases in gross profit and, except for beverage manufacturers, operating profit. 59 of the 70 companies (84%) had gross profit increases and 44 (73%) had operating profit increases. The companies with the greatest operating profit improvement in 2022 were McDonald’s, Yum Brands, Constellation Brands, Brown Forman, Restaurant Brands International and AB Inbev.

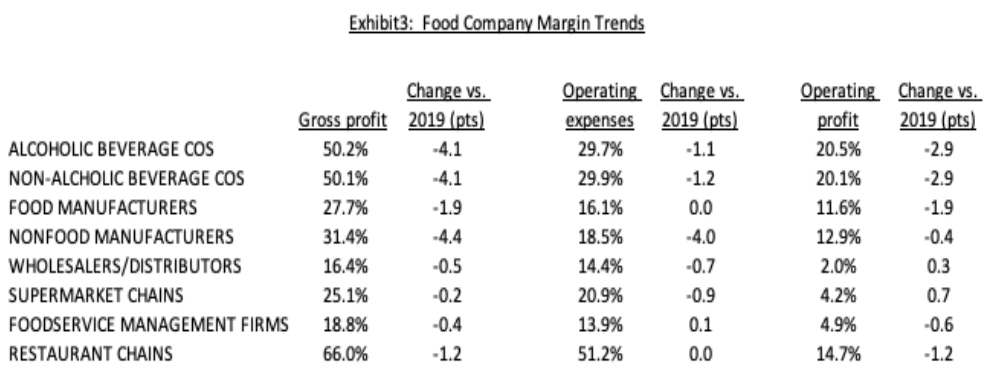

Food companies in all sectors have had gross profit margin declines since 2019. Operating expense control, some mix improvements and pricing actions have minimized the impact on operating profit margins; food and beverage manufacturers and restaurant chains have had the steepest declines

Going forward, we anticipate growing and significant consumer resistance to high food and beverage prices, which will favor private label and lower priced brands. Therefore, food companies will be far less reliant on price increases as a growth driver. To maintain or improve somewhat lagging profit margins in a slow volume growth environment, food companies will need to increase focus on operating expense reduction and brand building initiatives, while continuing customer and SKU portfolio management efforts.

By: Bob Goldin and Rob Veidenheimer

1Foodservice management firm 2022 sales are 8.6% lower than 2019

To review our findings and discuss the implications in greater detail, please:

Contact Us