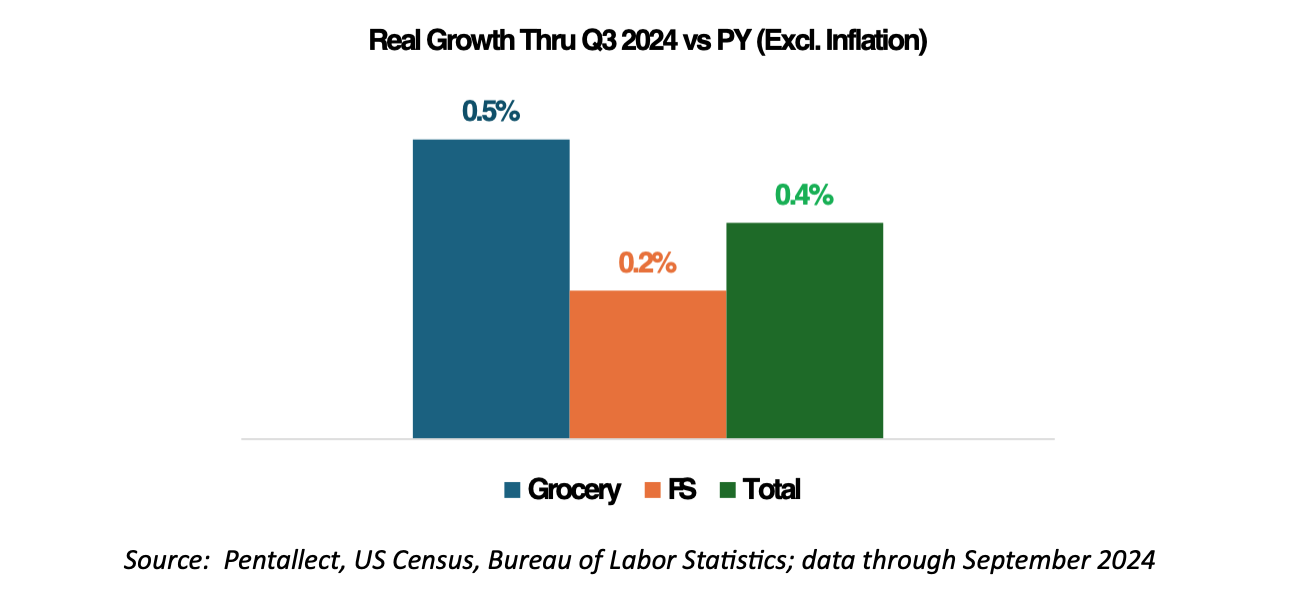

Both the retail and foodservice channels have experienced sluggish volume performance in 2024, as consumers sought value (often trading down), innovations have been minimal and slow to come to market, and volumes lagged historical levels.

To counter these trends, leading players in the marketplace, including manufacturers, operators/retailers, and distributors/wholesalers, will generally make volume growth a top priority for 2025. Pentallect believes that these efforts will largely be successful in 2025 in regaining some momentum, particularly for the foodservice channel.

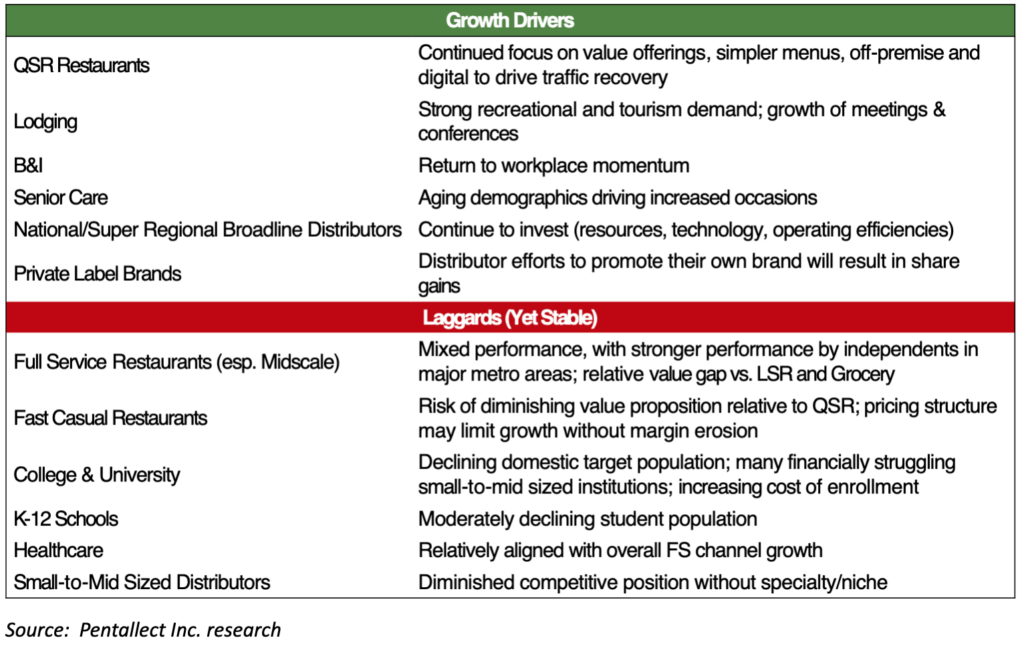

Key drivers for the foodservice channel in 2025 will include:

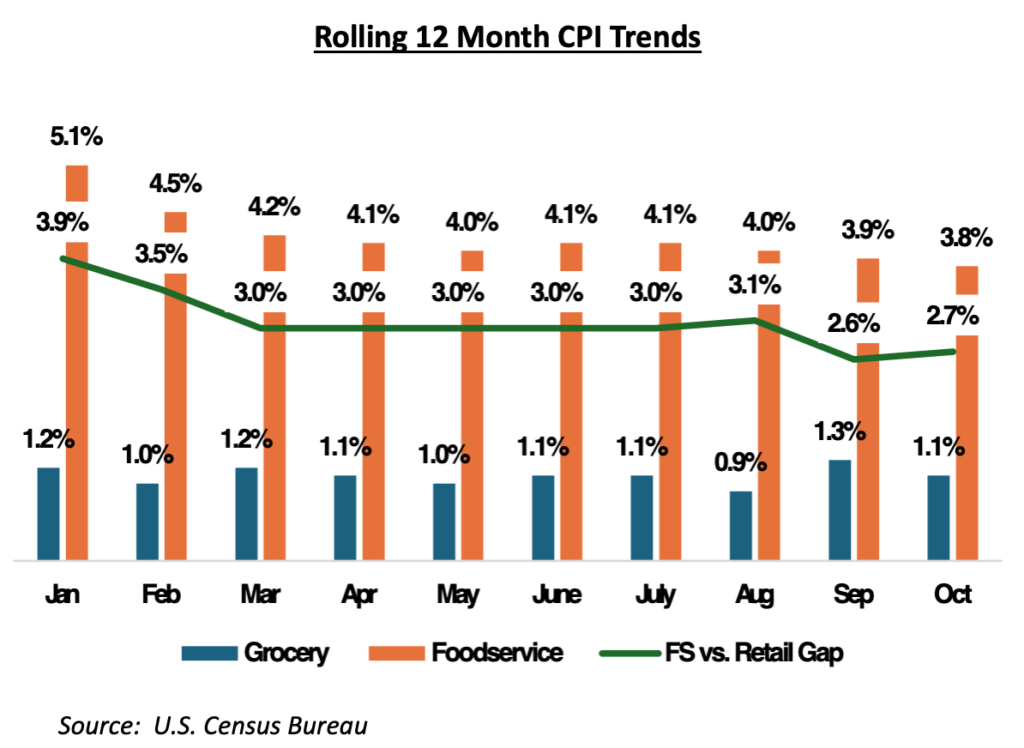

- Moderating inflation combined with a continued emphasis on value promotions by operators that will continue to reduce the relative but still considerable gap between foodservice and retail pricing, create an improved value proposition and encourage increased consumer occasions within the foodservice channel. Over the long term, we believe the foodservice channel is positioned to continue to outperform retail.

- Increased volume of new products and innovations introduced to the marketplace in late 2024 and 2025 after increased manufacturer investment in innovation pipelines over the past year.

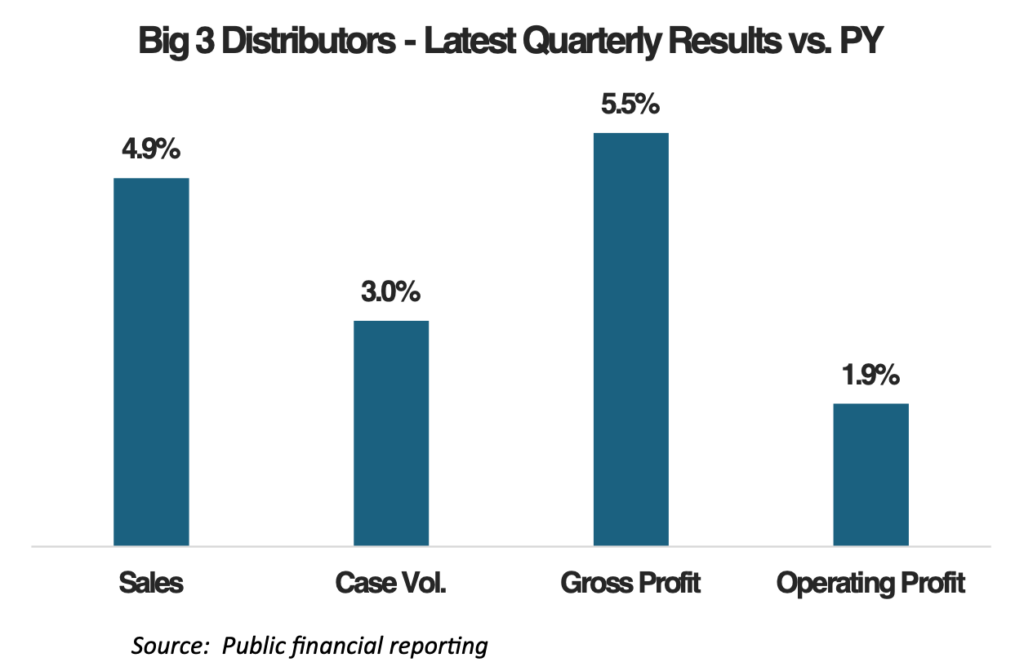

- Larger foodservice broadline distributors will continue to expand market share by leveraging their scale to build resource, technology and operational competitive advantages. These larger distributors will continue to target more profitable independent operators with their own brands.

- M&A as a vehicle to achieve volume growth, particularly among food manufacturers looking to expand offerings or access new categories or segments. We believe that M&A activity within the foodservice distribution marketplace will involve more strategic add-ons and selective geographic build outs, rather than deals with significant market share implications.

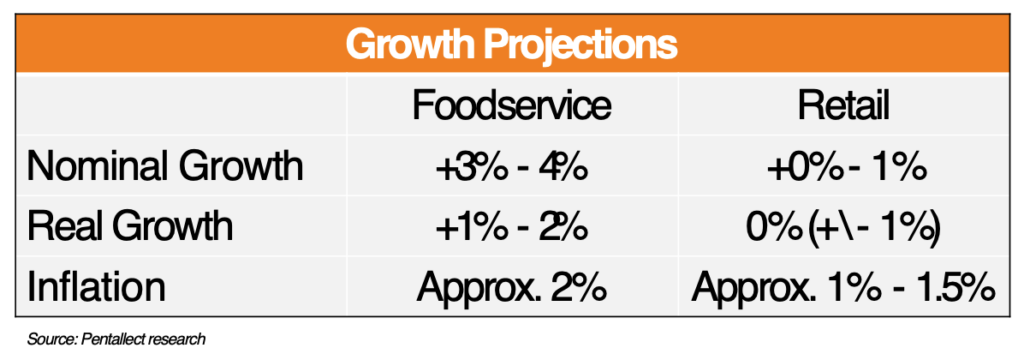

For 2025, Pentallect projects that the foodservice channel will grow +1%-2% in real terms, with an additional 2+% inflation to result in +3%-4% nominal growth; while the grocery channel will experience relatively flat performance.

Foodservice 2025 Growth Drivers and Laggards

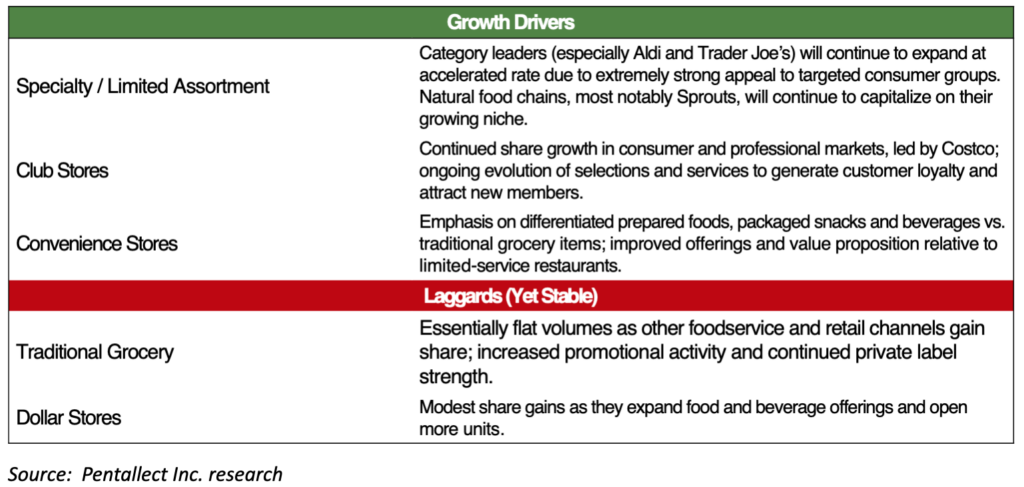

Retail 2025 Growth Drivers and Laggards

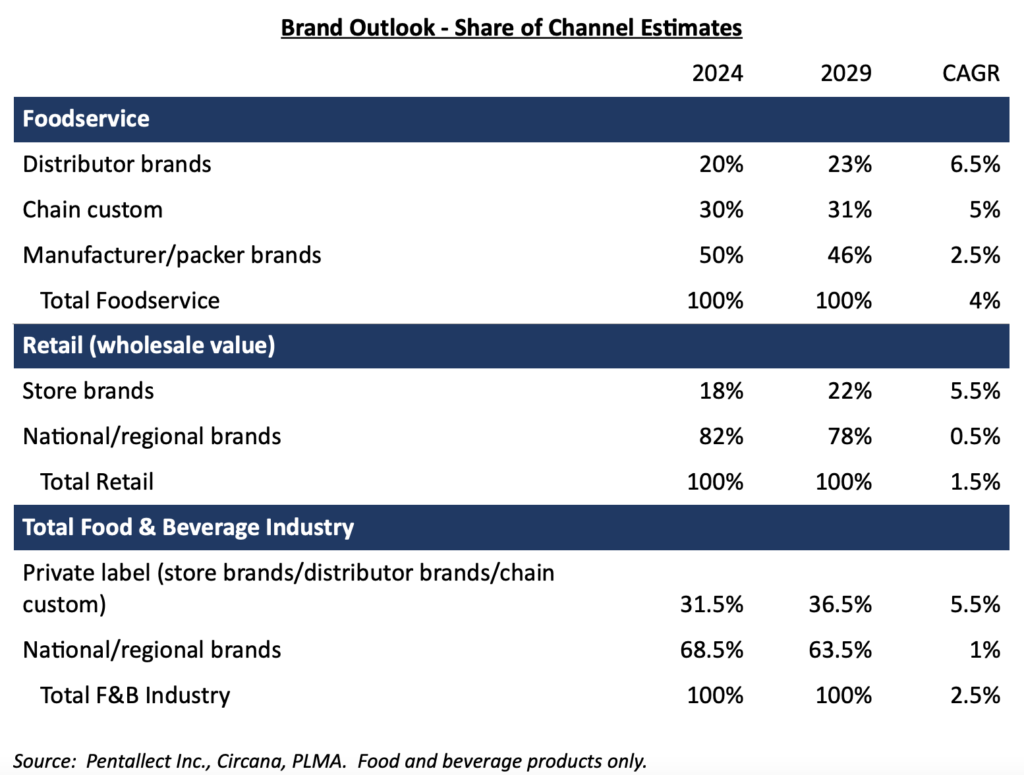

In foodservice, major distributors like Sysco, US Foods and Performance Food Group are intensely focused on their own brands and large restaurant chains, especially in the growing quick service segment, have long relied on custom formulations; in retail, leading supermarket chains (including Walmart) and grocery co-ops are increasingly effective in managing their store brands like “national” brands, with greatly improved product quality, variety, product and packaging uniqueness and in-store merchandising. As a consequence, we expect private label to gain significant share in both channels over the next five years, which will create very significant headwinds for national/regional manufacturers. Over the referenced time period, we forecast the industry value (at the wholesale level) will increase by $110 – 120 billion, with private label accounting for approximately 75% of that growth.

As we’ve previously reported, publicly traded food and beverage manufacturers have been experiencing top-line growth but volume declines. The top-line growth is entirely attributable to pricing. As post-pandemic pricing flexibility has almost completely waned, manufacturers’ profitability is likely to suffer as they rely more heavily on promotions to drive volume (and minimize the price gap between their brands and private label). This is likely to expose them to activist investors that demand improved performance and are willing to restructure businesses (including major cost cutting) to drive results. Jana Partners has taken a 5% position in Lamb Weston, and we fully anticipate that there will be many similar situations in the upcoming year.

By: Barry Friends, Bob Goldin, Gary Karp, Rob Veidenheimer