By: Rick Abraham | Rob Veidenheimer

September 23, 2020

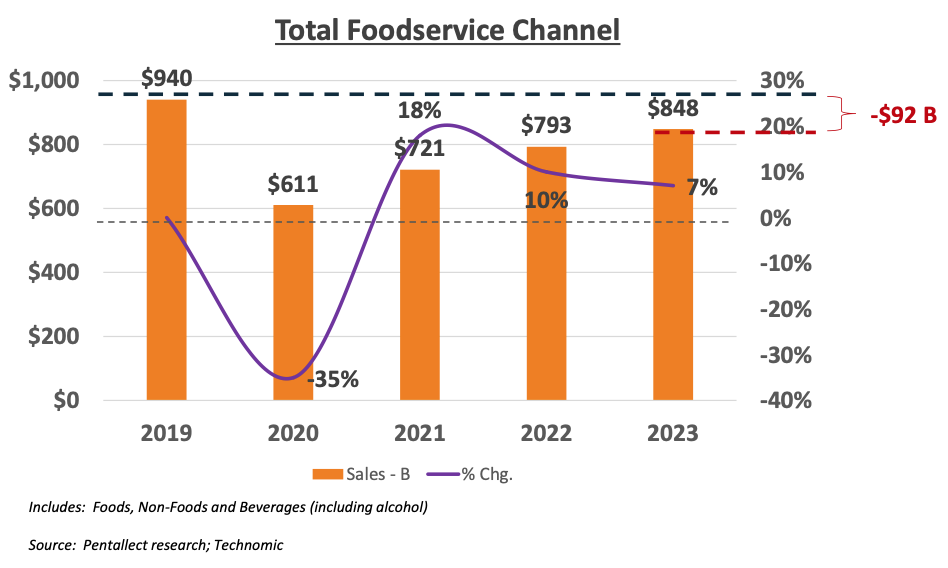

Driven by dramatic declines in the foodservice channel due to the COVID-19 crisis, the total food industry is projected to contract approximately $200 billion in 2020 as retail channel strength will not compensate for all of the foodservice losses.

This POV utilizes Pentallect’s three year projections through 2023 for go-to-market planning purposes. In 2023, foodservice channel sales are projected to be -10% smaller than pre-virus levels and the channel’s structure and operating practices will be significantly different from pre-pandemic dynamics. Pentallect estimates that it will take 4+ years for foodservice channel sales to recover to pre-virus levels.

A significant wildcard influencing foodservice recovery forecasts will be the longer-term economic impact of the virus and associated relief measures on consumer disposable income, employment levels, debt and taxes. All of which can impact consumer spending within the channel.

The dramatically different post-virus foodservice landscape will require organizations to redesign their go-to-market models to effectively compete. New foodservice channel dynamics that compel organizations to change include:

- Smaller Marketplace: As noted, Pentallect’s initial projections are that the foodservice channel will require 4+ years to return to pre-virus volume levels, if not longer.

- Fewer Customers: The National Restaurant Association estimates that over 100,000 restaurants have closed in 2020, and 40% of operators surveyed are concerned that they may not survive another 6 months without further relief programs. These unit losses will particularly impact independent restaurants that often lack the financial capabilities to survive the shutdown and recovery. Non-commercial operators and GPO communities will also experience a reduction in participants driven by financial pressures, industry contraction and consolidation. While many closed operators will eventually reopen in some format, their return will take years for total location counts to recover to anywhere near pre-virus levels. Many locations that remain open will operate at reduced volume levels due to capacity limitations.

Consolidation will also continue within the distribution community, as distributors expand capabilities, market and channel coverage by acquiring strategic or financially weakened assets.

- Revised Growth Pockets: The marketplace will reset, with new groups of “winners” and “losers” across segments, customer groups and distribution entities. Growth opportunities will vary by participant based on their unique product and packaging offerings, brand strategies, customer portfolio and market positions.

- Fewer Demand Creation Resources: All supply chain participants have reduced the number of sales resources, including manufacturers, distributors and sales agencies. While some of these resources will be reinstated as the industry recovers, most organizations will not return to pre-virus levels over the next 2-3 years. Many major distributors (most notably Sysco and USF) have permanently (or semi-permanently) reduced their DSR headcount by 35%. They recognize that they will need fewer sales resources going forward. The same dynamic holds true for most manufacturers.

- Sustained Virtual Business Development: The marketplace has grown accustomed to fewer face-to-face business development interactions. While in-person meetings will maintain an important post-pandemic role in certain instances, customers will expect continued utilization of virtual meetings for improved time management and efficiencies. This will include capabilities reviews, new product presentations (samples can be sent in advance with “live” virtual cuttings) and ongoing touch point meetings. Food shows and trade events will also be dramatically scaled back and become virtual for the foreseeable future. This will impact the alignment of resources and technologies for manufacturers and broker agencies, who will need to determine the optimal balance of in-person versus digital business development capabilities.

- Shifting Brand Dynamics: The largest broadline distributors will likely increase emphasis on their own brand portfolios to drive profitable growth. In the face of declining independent operators, traditionally the prime target for these distributor brand efforts, distributors will look to expand their branded portfolio within other operator segments and branded manufacturers will need a compelling brand strategy to maintain share.

Most organizations’ go-to-market models reflect old marketplace dynamics, not the new realities. These legacy organizational strategies and resource alignments are increasingly inefficient and will deliver sub-optimal results in the evolving foodservice channel. Organizations must act boldly to redefine their go-to-market models and organizational designs to adapt to the new market realities and position the organization for sustained success.

How organizations position themselves coming out of the crisis will define future success. Now is the time to prepare and accelerate transformation.

It’s not sufficient to merely downsize due to the pandemic. It’s about strategic repositioning to manage short-term market dynamics while positioning for growth acceleration in 2021 and beyond. Imperatives include:

- Ensuring that resources are appropriately redeployed against growth opportunities by operator segment and distribution system, with effective balance between headquarters and local market customer decision points. These customer priorities will be different from recent priorities.

- Reassessing roles & responsibilities for direct teams and broker agencies. This process includes an evaluation of resourcing requirements to support priority customer groups, clear delineation of roles and responsibilities across the go-to-market team and an assessment of the evolving business development capabilities required in the new operating environment. Traditional sales roles will change with smaller teams and less travel, face-to-face meetings and prospecting; plus more focus on core products and brands.

- Achieving acceptable ROI in the short-term while aligning for a recovery starting in 2021. Delivering cost savings and growth momentum will be critical.

- Creating a strategic balance of physical resources versus digital business development capabilities. This will include an expanded digital presence (customer engagement, training, customer service, marketing, etc.), streamlined business practices to minimize complexity (SKU rationalization, pricing and promotional practices, etc.) and CRM/TPM tool advancement to identify specific white space opportunities and measure results against identified action plans.

- Creating a clear and compelling differentiation strategy. Commoditization in foodservice, even pre-pandemic, has been a growth inhibitor and the challenges in the post-pandemic world will only increase the need to differentiate products, services, CRM approaches, technology adoption and go-to-market models. If companies don’t have a succinct and scalable “This is why you should buy from me…” message, profitability will suffer.

- Embracing new methods of demand forecasting and fulfillment. “Always on” digital 24/7 connections with customers (beyond typical order management functions) must be used to develop deeper customer relationships that will foster a better understanding of needs and buying patterns. Companies will need to insert themselves into their customers digital life in a world class fashion.

- Increasing focus on identifying and pursuing alternative/new revenue sources, including new channels, customer types, routes-to-market and product/packaging innovations.

We are actively engaged with many of our clients to address these complex issues and position their organizations for future success. In addition, we have developed a detailed roadmap filled with valuable data, information and insights. Please contact us to discuss your go-to-market model within the context of the current and post-pandemic operating environment.