February 19, 2021

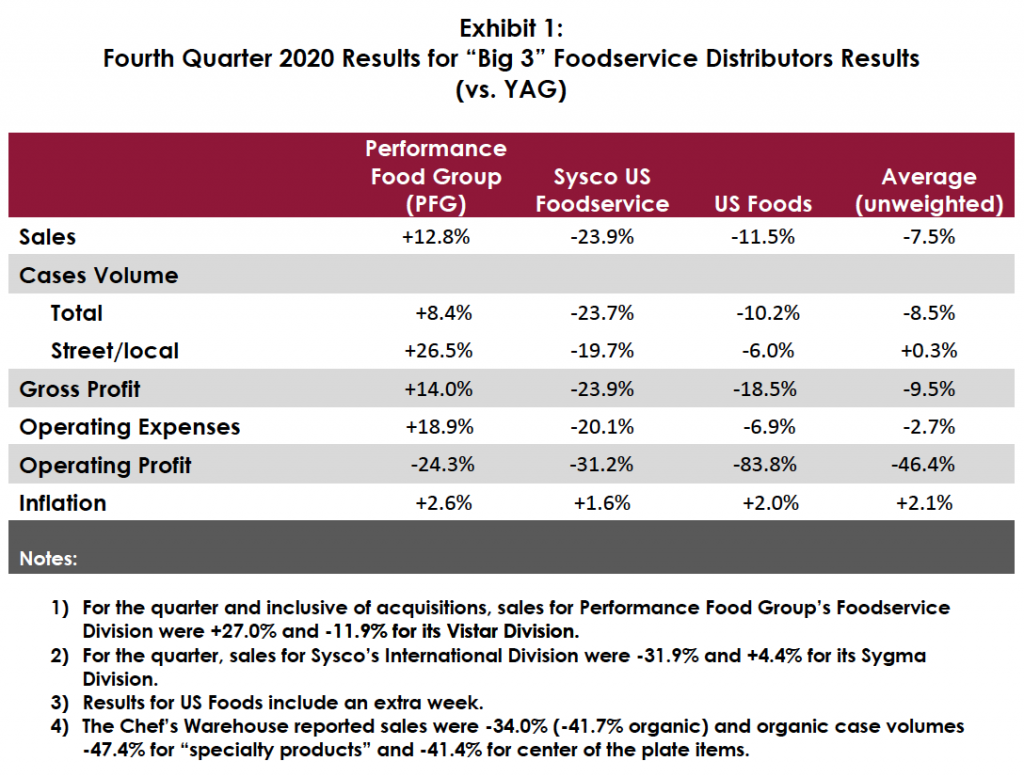

Due to the Covid-19 surge, the foodservice industry experienced a significant and unfortunate slowdown in the final weeks of 2020. During the quarter, major markets – most notably the densely populated Northeast, Midwest and West Coast – were under strict operating restrictions and/or shutdowns, many of which are still in effect. As a result, the “Big 3” foodservice distributors – Performance Food Group, Sysco and US Foods – suffered double-digit declines in organic case volumes (-20.3% on average) and operating profit (-46.4%) vs. the prior year. Despite the disappointing results, the companies’ officers express a fairly high degree of optimism about the near-term prospects for their businesses and the industry as a whole and report that they are investing in people, inventory and technology to take full advantage of an anticipated strong rebound. Their confidence is based on a number of internal and macro factors, including pent-up consumer demand, disposable income, government relief and stimuli, expanded vaccination roll-out, an improving economy, and their own strategic initiatives and operating model enhancements enabled by ample liquidity and generally solid cash flow. The referenced companies also noted that they are gaining market share through both customer wins and increased account penetration.

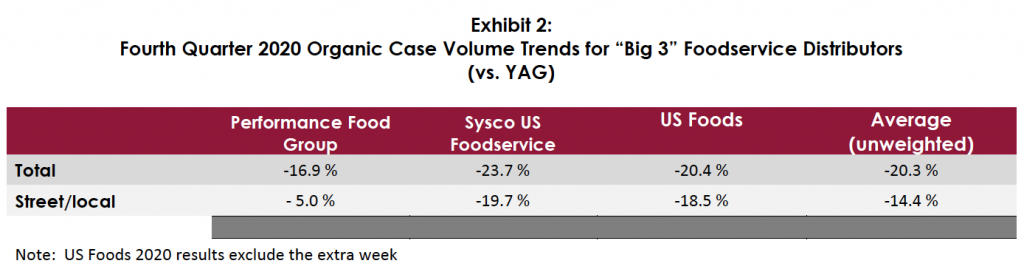

As shown in Exhibit 2, the “Big 3” reported organic case volume for “street/local” accounts¹ were -14.4%, which is better than the “street/local” market performance as a whole (Pentallect estimates that independent restaurants (a segment that is dominated by full-service types) were down 20 – 30% for the quarter). As the organic case volume metric includes both new and existing customers, it is evident that the “Big 3” have aligned themselves with and provided real value (such as lower/no order size minimums, extended terms, and other consultative services) to “best in breed” operators (including new customers) and are successfully increasing account penetration. This bodes well for future profitability as the independent restaurant segment is highly margin accretive, albeit shrunken in size (at least for the foreseeable future). Sysco reported a huge (1,000 basis point) increase in their Net Promoter Score, indicative of success in “going the extra yard” to meet customer needs.

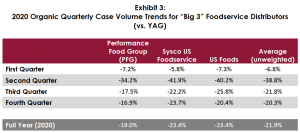

The following exhibit illustrates the extent of the “damage” caused by the pandemic – as a group, the “Big 3” are -21.9% in organic case volume. Even with a buoyant recovery, recovering the lost volume will be a multi-year effort².

A few other points that can be gleaned from the “Big 3’s” remarks and reports:

- The “Big 3” executives continue to report that there have been fewer restaurant closures than reported. They largely attribute that to highly resilient and adaptive operators; it may also reflect their selectivity in customer targeting. Pentallect does believe the closure rate will likely increase during early 2021, although additional government relief should help alleviate the situation.

- A number of major segments and customer types such as lodging and foodservice contractors are likely to have a longer recovery period as many businesses and travel-dependent accounts are slow to return to pre-Covid levels.

- Distributor brand sales have slowed due to customer mix changes (certain high volume user segments have experienced very steep volume declines).

- Many large volume customers are actively seeking “secure” and reliable supply sources, which favors companies like the “Big 3” and translates into profitable new business opportunities.

- Vendor service levels continue to be an industry-wide challenge. A number of large distributors have instituted penalties and fees for sub-par service levels and late deliveries.

- To date, there has been less M & A activity in the distribution sector than anticipated due to the challenges of establishing normalized EBITDA for valuation purposes. We expect M & A activity will pick up as the industry returns to a more “normal” operating environment.

Like the “Big 3,” Pentallect is confident that there will be a strong bounce-back (hopefully beginning in the second half of the year). While we do see “light at the end of the tunnel,”, we expect that the recovery will be nonlinear and may be delayed for a variety of external reasons. The “Big 3’s” optimism and investment posture are understandable, given their enviable and strengthened competitive positions, but is unique to them vs. the market as a whole.

¹ Each company defines “street/local” somewhat differently.

² The foodservice distribution industry shrunk by $85 billion (27%) in 2020.

By: Bob Goldin | Barry Friends

I’m interested in learning about Pentallect’s latest strategic initiative, “2021 Recovery Plan Playbook”: