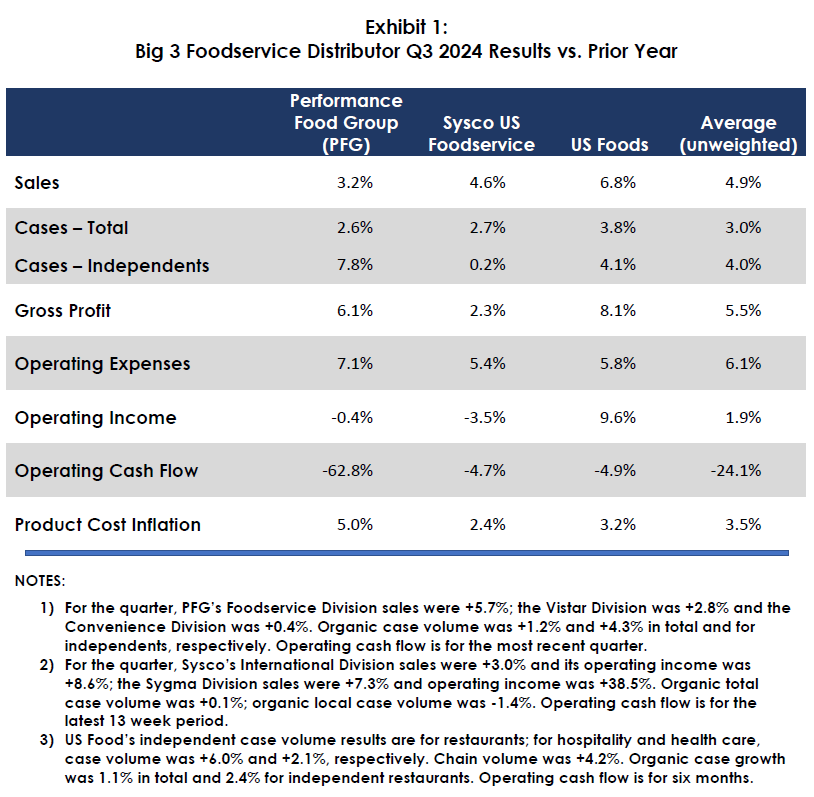

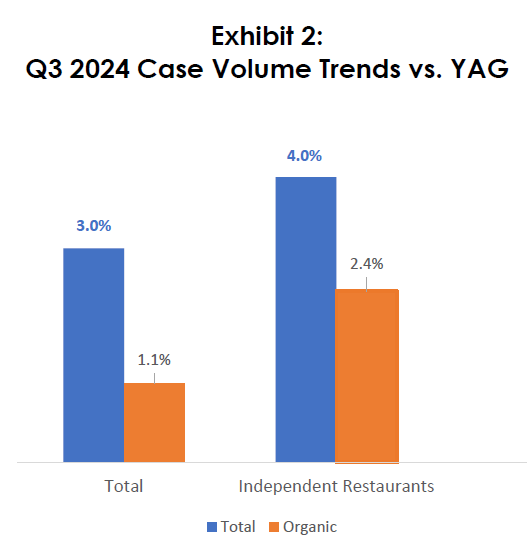

The third quarter results of the Big 3 publicly traded foodservice distributors (Performance Food Group, Sysco Corp. and US Foods) were in line with analyst and industry expert expectations given restaurant traffic declines1 that are largely attributable to ongoing (but seemingly a bit reduced) consumer pushback on high menu prices. The companies did manage to grow total and organic case volume by 3.0% and 1.1%, respectively (see Exhibit 2), and to increase per case profitability. Continuing a trend, the performance of the Big 3 is being boosted by improved customer and product mixes (especially increased volume with the highly profitable independent restaurant segment), portfolio diversification, positive contributions from M & A activity, some productivity enhancements and a resilient end market.

In our view, the foodservice market has returned to pre-pandemic patterns of slow but steady growth and overall stability. Despite the challenges faced by many major chains, we are guardedly bullish on 2025 industry prospects, which bode well for distributors. The reasons for our cautious optimism are as follows:

- Many operators are focused on improving their value positioning and customer experience, and these efforts are generally resonating with consumers.

- Workers are returning to the office, which will boost B & I and restaurants, especially “city center” types.

- Travel, including foreign tourists, remains very strong, and that directly benefits lodging and recreation.

- The economy is in very good shape by most measures, which is stimulative.

- Many retail segments, including traditional supermarkets, are experiencing volume losses, indicating that foodservice is regaining share of spending.

- The disintermediation risk seems to have abated, and the distribution industry remains fragmented, with no evidence of consolidation.

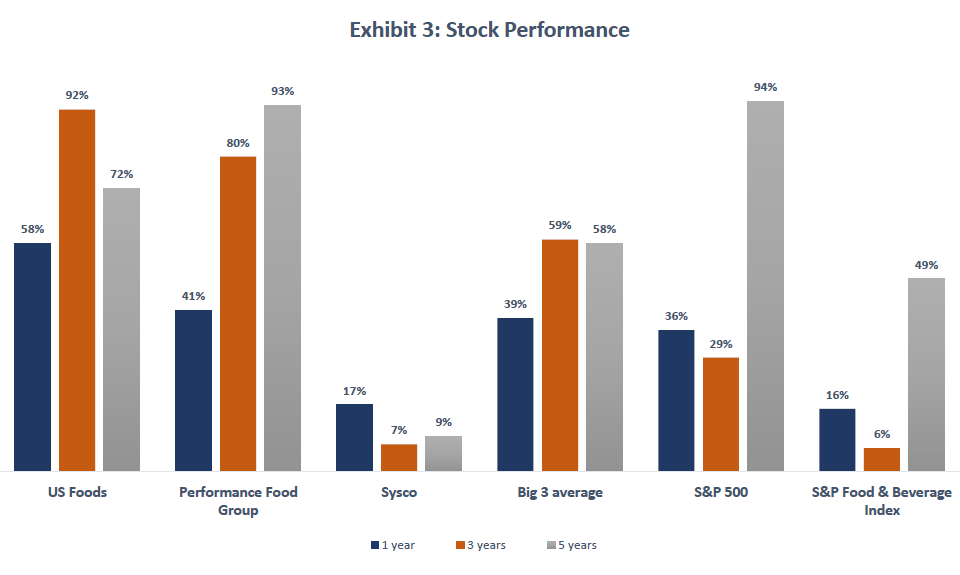

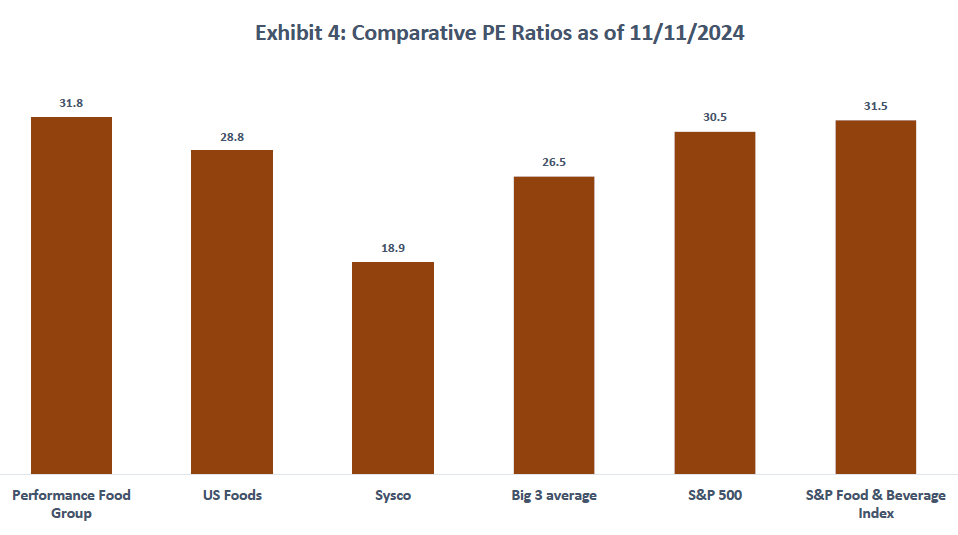

The stocks of the Big 3 have generated positive returns for one-, three- and five-year periods and significantly outperformed the S & P Food and Beverage Index, but they have not done as well as the overall market (as measured by the S & P 500 index) and their current price earnings (PE) multiples are lower than the S & P 500 and the S & P Food and Beverage Index. This indicates that the market views the foodservice distribution industry as less attractive than many other sectors; this view is likely due to the relative maturity and the structurally low margin nature of the business.

The Big 3 companies are each well-managed, strategically focused, operationally savvy and financially advantaged. However, their sheer size, slow industry growth and very capable competition present significant top-line growth challenges, leading them to focus on profit enhancement as a top go-forward priority to reward shareholders.

By: Bob Goldin and Barry Friends

- Restaurants represent around 50% of Big 3 sales (Sysco’s ratio is higher) ↩︎