by: Barry Friends | Bob Goldin

June 27, 2017

Blue Apron has issued a detailed prospectus in advance of its planned public offering that will value the company at over $3 billion. The document sheds light on a small, explosive growth and high interest food industry segment. We would like to provide some commentary on the meal kit market (which includes prepared meals), with specific focus on addressing its real impact – is it to retail, foodservice or some combination of both?

Blue Apron has issued a detailed prospectus in advance of its planned public offering that will value the company at over $3 billion. The document sheds light on a small, explosive growth and high interest food industry segment. We would like to provide some commentary on the meal kit market (which includes prepared meals), with specific focus on addressing its real impact – is it to retail, foodservice or some combination of both?

To put the meal kit market in context, it is $2.2 billion – a “rounding error” in the $1.5 trillion food industry. However, it is experiencing exponential growth, and Pentallect forecasts that that annual growth will be in the 25 – 30% over the next five years. According to our consumer research, only 3.8% of the surveyed households have tried a meal kit in the past 30 days, and 27% are interested in trying one (other sources suggest the penetration is more around 2%). The low household penetration provides significant headroom for growth. Furthermore, online and traditional retailers are entering the market and some, like Amazon (possibly in combination with Whole Foods), are likely to be successful. Further, major food companies like Nestle and Unilever are investing in the meal kit providers.

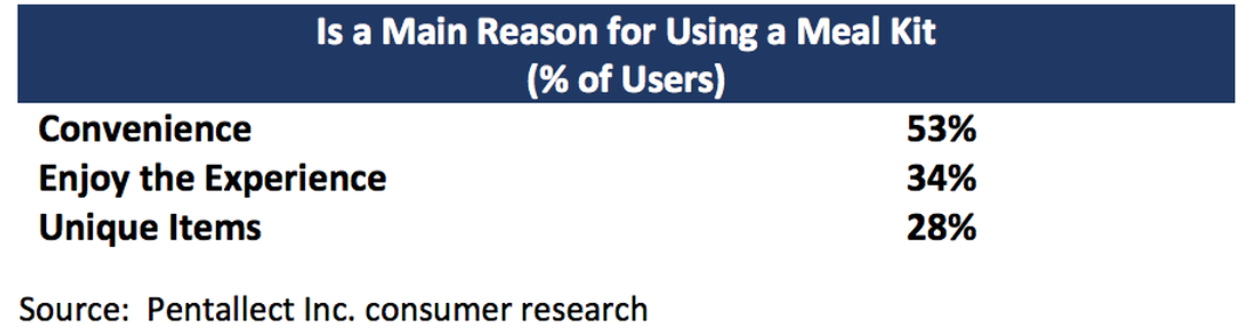

Our research reveals that there are several main reasons why consumers use meal kits, and they are powerful.

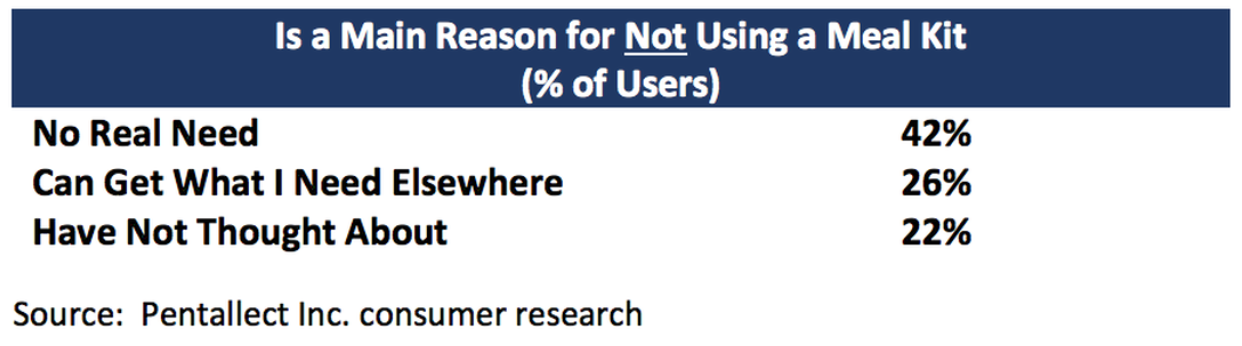

The reasons why consumers do not use meal kits can be overcome by creative marketing. The reasons are:

While there is certainly a “novelty factor” (25% of users say they have tried a meal kit out “curiosity”), meal kits are succeeding to a significant extent because they are bringing the experience of eating out to the home, with experience defined in the context of differentiated recipes, specialty ingredients, variety, a “fun” factor and overall high quality. This attractive benefit bundle is being provided at about $10 per meal per person, which is at least $7.50 per person less than full-service restaurant dinner spending (spending on a full-service restaurant meal includes tax, tip and/or other fees like parking). Many restaurants, most notably casual dining chains, are not currently meeting consumer expectations with respect to these important drivers. This “experience gap” has created a real vulnerability for restaurants, and meal kit companies are exploiting it. And while the retail packaged goods industry does provide low cost and convenient options, it appears to be falling far short in responding to consumer needs with respect to fresh, natural and real ingredients and in taste/flavor. Consequently, volumes have been flat to down for the past several years, and the general trend is expected to continue and possibly even accelerate.

The meal kit market will face significant and costly customer acquisition and retention and supply chain challenges. There are already signs of a shake-out. However, the market is still in its infancy and targets 25 – 44 year olds, a key demographic for the full-service restaurant industry.

The restaurant industry is choosing to improve its lot by increasing its convenience level (especially in the deliveries) and overall digital sophistication. These are sound initiatives but do not negate many the inherent strengths of the meal kit market.

As the meal kit market expands, the restaurant industry is poised to lose millions of occasions and billions of dollars to this new form of competition.This adds new pressures for the industry to rethink its practices and make appropriate corrections.