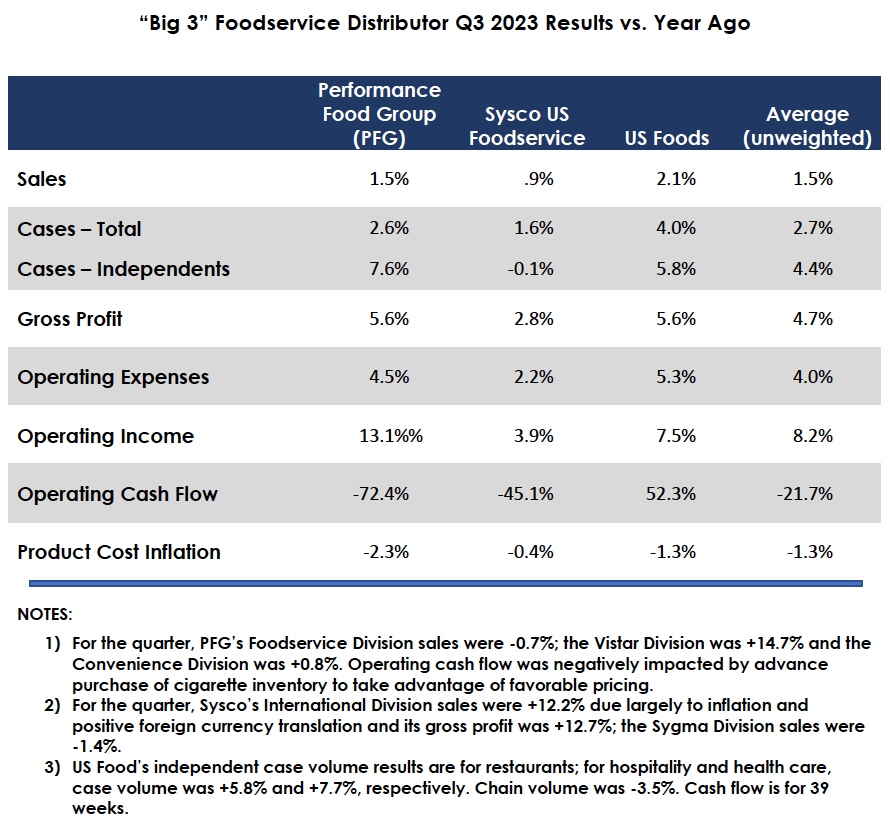

The “Big 3” foodservice distributors have a 35 – 40% share of market1 and, as such, are a reasonable proxy for the broader market. Their most recent results, most notably their total and independent case volume growth of 2.7% and 4.4%, respectively, seemingly indicate that the foodservice industry is performing far better than many industry analysts predicted.2 While traffic is sluggish, consumers are spending, new units are opening/reopening, and most noncommercial segments are continuing to rebound. The “Big 3’s” volume growth is clearly benefitting by solid end-market performance; given our belief that major regionals and large independents are doing well, we do not think the “Big 3” are gaining significant share at this point.

For the first time in recent memory, there is actual deflation in product costs. As evidenced by the sales (+1.5% vs. +2.7% case growth), the “Big 3” are passing these price reductions along to their customers, a high ratio of which buy on a contractual basis. At least to date, it does not appear that operators (the “Big 3’s” customers) are passing much, if any cost reductions along to their consumers. To be fair, we recognize that many operators are still absorbing and responding to the rapid rise of food and labor costs over the past two years, and that for many, the “cost” of doing business has yet to have been fully shared with consumers.

The “Big 3” continue to manage customer and product mix and control operating costs effectively. Despite the deflationary spiral, they have been able to increase gross profit per case, a critical profit determinant. And they are all investing in sales force expansion in an effort to increase account penetration (“share of wallet”) and gain new accounts.

In prior POVs, Pentallect predicted that foodservice distributor merger and acquisition (M & A)activity will increase in the near future, and this most recent quarter saw two significant transactions: the pending acquisition of Edward Don, a $1+ billion equipment and supply specialist, by Sysco, and the recently announced acquisition of Saladino’s, a $600 million California based broadliner, by US Foods. Both these acquisitions provide the acquirers with added capabilities.

We expect foodservice distributor M & A to continue to be active for a variety of reasons:

- Industry conditions have normalized, allowing buyers to get a more accurate gauge on candidate performance.

- Major strategic and financial buyers are attracted to the stability of the market.

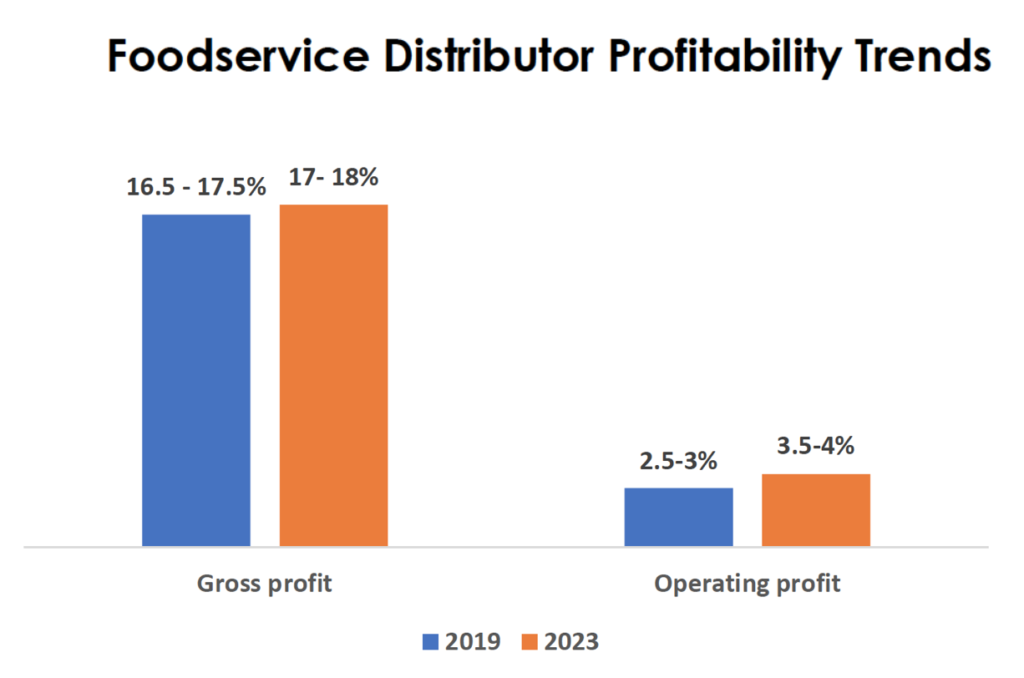

- Distributors have become more profitable, and thus more attractive to buyers; Covid was a “wake up” call. As shown below, we estimate that distributor gross and operating margins have increased since 2019.

4. Given the current multiples being paid, buyers are likely more willing to entertain offers, especially as many independents lack comprehensive succession plans.

We are fairly confident (underscore “fairly”) that the foodservice market will maintain its current momentum, largely driven by full employment and modest real wage growth. That being the case, we expect to see the “Big 3” continue to perform at their usual high level.

By: Bob Goldin and Barry Friends

- For this calculation, the Big 3 sales exclude Performance Food Group’s Convenience and Vistar Divisions. ↩︎

- As another reference point, the other major publicly traded foodservice distributor, Chef’s Warehouse, reported an approximately 8% volume increase. Chef’s Warehouse is oriented toward independent restaurants. ↩︎