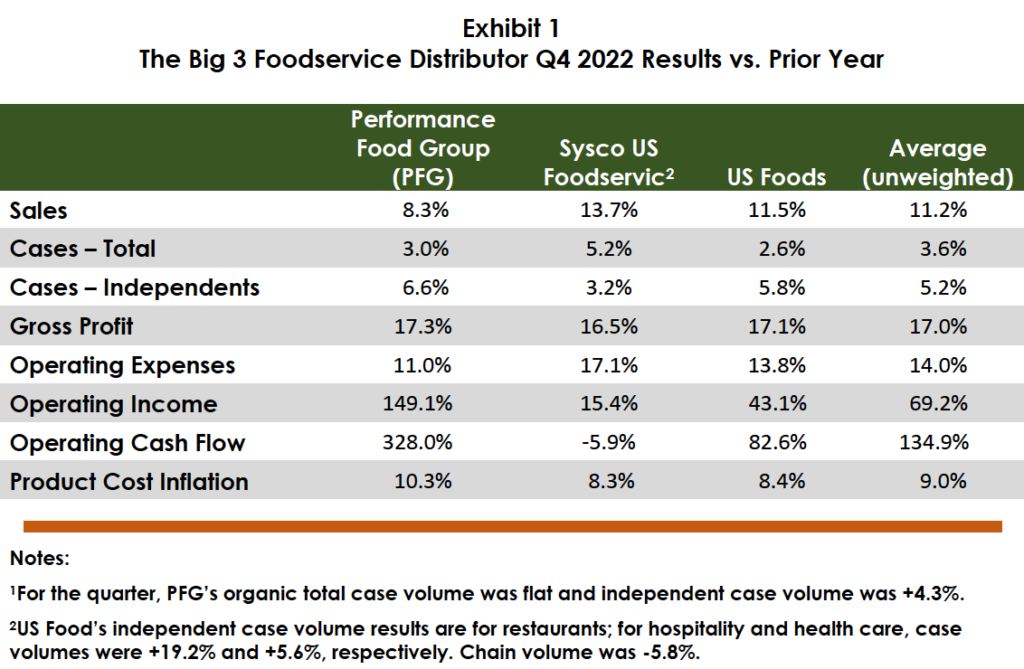

For the fourth quarter of 2022, the Big 3 foodservice distributors reported revenue and total case growth of 11.2% and 3.6%, respectively; organic case volume was +2.6%. These results are in line with 2022 industry growth estimates, which Technomic reported as 11.0% (3.2% on an inflation adjusted, or real, basis). The Big 3 (and other channel members) have been successful in passing along price increases, and this – along with customer mix improvement – has been the major contributor to top-line growth and, to a large extent, improved profitability. Strong and more robust operating cash flow has enabled the Big 3 to deleverage and invest in their businesses.

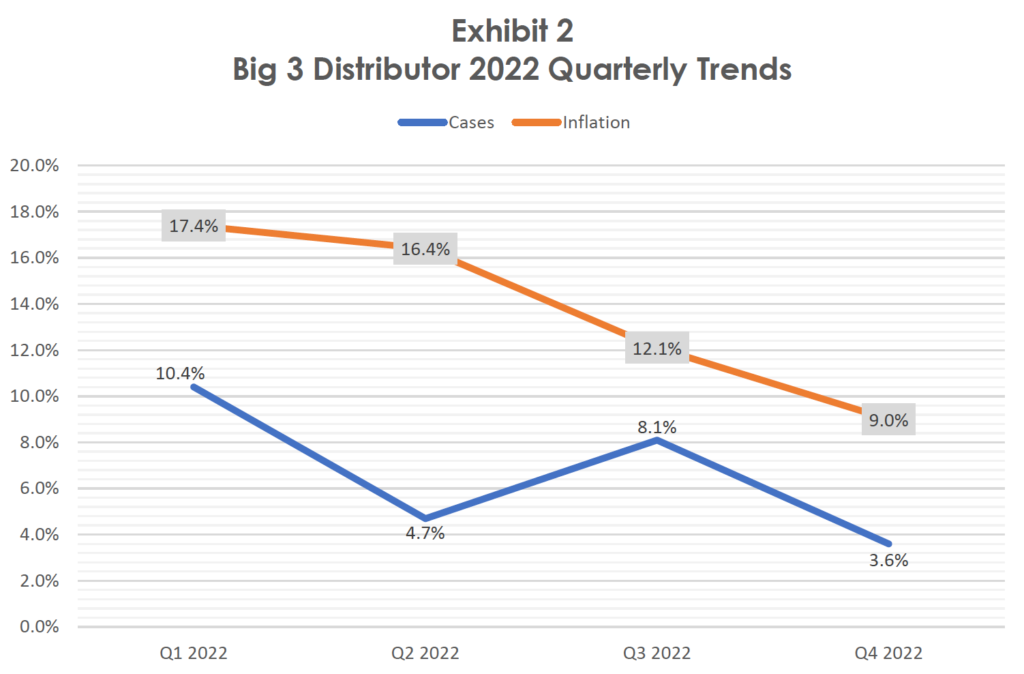

While the Big 3 have had impressive profit growth, they are showing a significant increase in operating expenses (averaging 14.0% in the referenced quarter). The expense increase is due to the need to service key customers in a challenged time, and thus is fully understandable. However, as inflation recedes (as shown in Exhibit 2) and independent market penetration gains become more difficult to achieve due in part to a smaller “universe,” operating expense control will necessarily become more of a priority for the Big 3.

In 2022, food and beverage manufacturers raised price by 12.5%1. For the most part, trade customers and consumers accepted these higher prices; most analysts have been surprised by the relative price inelasticity in retail and foodservice markets where consumer prices were +11.8% and +8.3%, respectively. However, we strongly believe pricing has reached a tipping point and that further price increases will be extremely difficult to implement at any level in the industry. Walmart has “warned” its packaged goods suppliers that it will “push back” on future price hikes (and increase its focus on its lower cost alternatives). We fully expect a similar dynamic to take place, with considerable success, in foodservice, with operators likely to take the ”lead” in pushing back on further price advances.

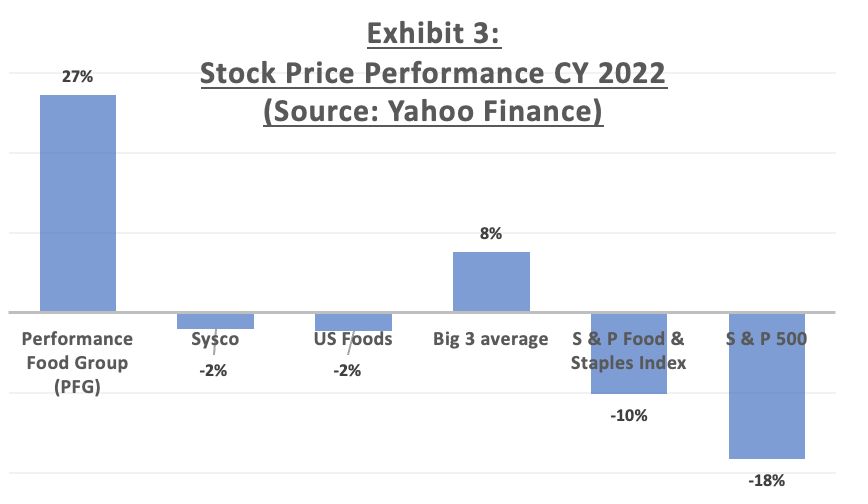

As we have previously discussed, the Big 3 have enhanced their effectiveness and improved their market position during the COVID era. 2022 was no exception and the stock market has recognized this superior performance – as a group, the Big 3 have outperformed the overall market and industry-like indices.

Despite ongoing dramatic improvements in the travel & leisure and B & I segments, growth in 2023 is likely to be far more modest than in 2022. That being the case, the Big 3 and other industry participants will be required to operate even more efficiently and effectively to ensure continued growth and improved financial results.

1Based on Pentallect analysis. For additional details, please:

Contact UsBy: Bob Goldin, Barry Friends and Chris Davis