A year ago, the industry was recovering, and food cost inflation was 16.4% (a rate that, in hindsight, is hard to fathom). Consequently, the Big 3 sales were +29.5% and case volume was a healthy +4.7%.

What a difference a year (and sharply lower inflation) makes!

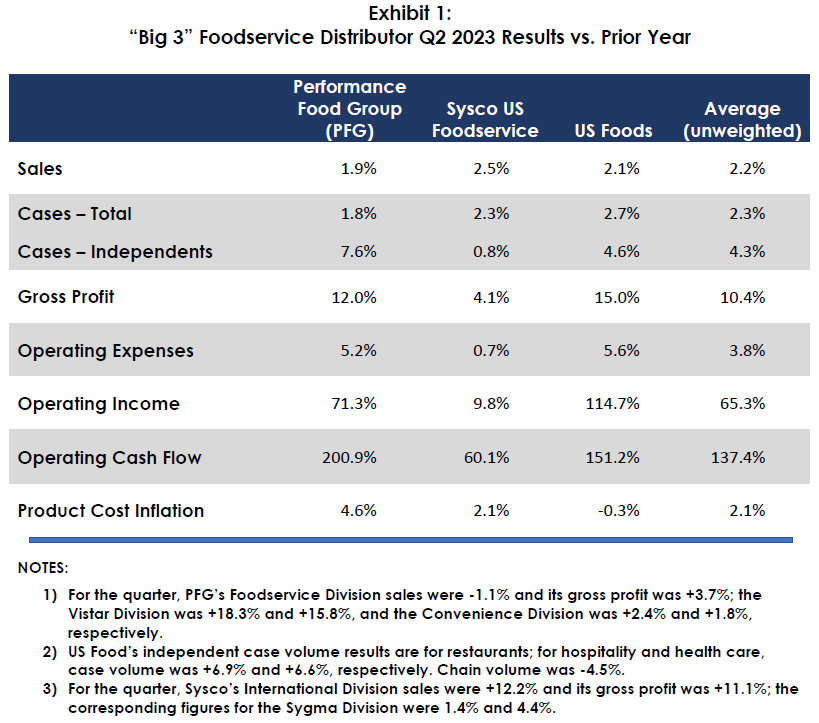

For the most recent quarter (ending in June 2023), the Big 3’s top-line results reflect modest sales and total case volume growth of 2.2% and 2.3%, respectively. However, a more favorable customer mix and solid expense control have resulted in impressive growth in profitability and operating cash flow. The high level of and growth in operating cash flow will continue to enable the companies to make strategic investments (including acquisitions), deleverage and return money to shareholders in the forms of stock buybacks and dividend increases. In a “high cost money” environment, this liquidity is an increasingly valuable strategic advantage.

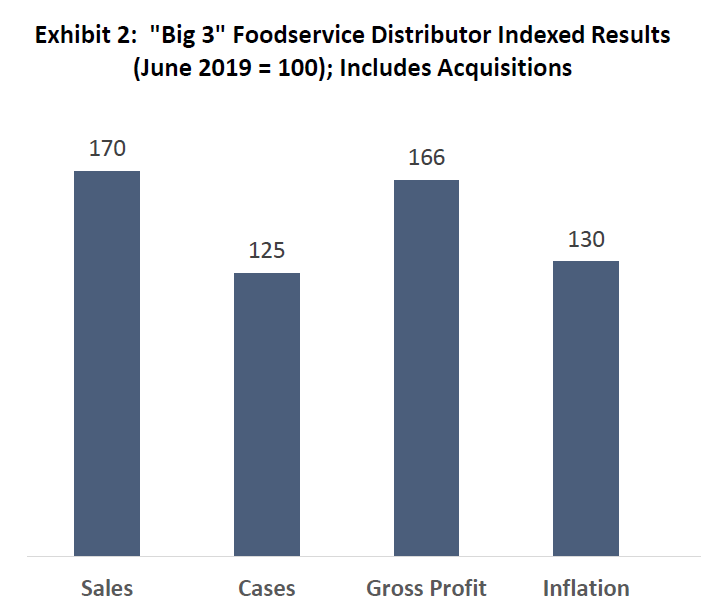

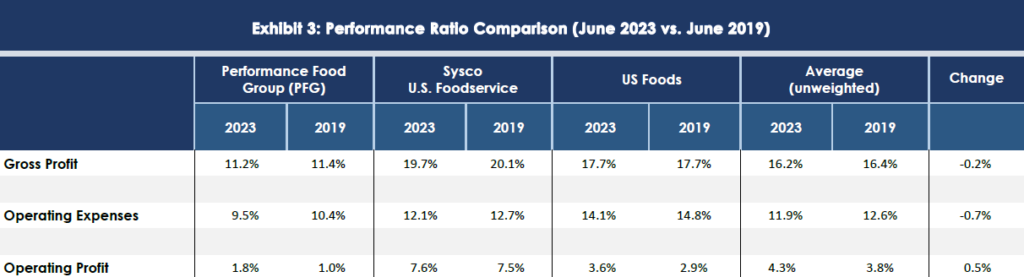

As shown in Exhibit 2, the Big 3 have experienced truly admirable performance during the past four years, a period of unprecedented and unimaginable industry volatility. They are “bigger and better” now than they were in 2019; sales, case volume and gross profit are up, including in organic terms. The top-notch performance is attributable to several factors, including a customer “flight to safety” during the peak Covid era, a resilient end market, government support for many beleaguered operators, and, most importantly, appropriate strategic focus on value-adding initiatives and investments, including cost reductions, acquisitions, and overall efficiencies. As shown in Exhibit 3, the Big 3 have managed to lower their operating expense ratio by 70 basis points which has led to a higher operating profit level.

But before applauding too loudly, note that absent from Exhibit 3 (because the Big 3 do not disclose “per case” values) is the fact that operating expenses, while improving 70 basis points, have increased greatly in real terms, roughly $1.20 per case, generally in line with the illustrated 30% inflation and faster than any period in the industry’s modern history. Higher transportation and warehouse labor costs have been inescapable and will continue to pressure the Big 3 and other distributors during the current and likely future labor scarce environment.

While the Big 3 results may be attributable to a slowing end market, and weak restaurant traffic numbers are an indicator of such, we continue to be surprised at consumers’ ongoing demand for foodservice and willingness to pay highly inflated restaurant prices, including annoying surcharges. We suspect the “bubble will burst” at some point, which will put pressure on industry suppliers. Further, as industry conditions continue to stabilize, low prices will once again become a key buying criterion for trade customers.

The industry will most likely return to its modest but steady real growth of 1 – 2% per year. To outperform the field in a meaningful way, we believe the Big 3 will ramp up their M & A activities considerably. As we noted, they are in an ideal position to do so.

We will be discussing the Big 3 and other key distribution related topics at our upcoming seminar.

By: Bob Goldin and Barry Friends