by: Bob Goldin | Barry Friends

August 27, 2018

Performance Food Group, Sysco, and US Foods recently reported second quarter results, and all three showed progress against one of their key strategic initiatives, namely growth in “local” or, as some refer to it, independent restaurant business. On a weighted average basis, the three largest broadliners had a 4.7% case volume increase with independents, which represents 9.5 million more cases vs. the same time last year. And at least half of those cases are private brands, the growth of which is another strategic priority against which the three companies are executing extremely well to their profit advantage. This incremental case volume translates into 7,500 truckloads (an amount which exacerbates the current and worsening logistics crisis).

Performance Food Group, Sysco, and US Foods recently reported second quarter results, and all three showed progress against one of their key strategic initiatives, namely growth in “local” or, as some refer to it, independent restaurant business. On a weighted average basis, the three largest broadliners had a 4.7% case volume increase with independents, which represents 9.5 million more cases vs. the same time last year. And at least half of those cases are private brands, the growth of which is another strategic priority against which the three companies are executing extremely well to their profit advantage. This incremental case volume translates into 7,500 truckloads (an amount which exacerbates the current and worsening logistics crisis).

This performance is particularly impressive when taken in the context of the underlying dynamics of the independent restaurant market. While economic conditions are certainly a positive foodservice growth stimulant, most of the 5% independent restaurant growth is due to menu price increases and some mix improvements. Pentallect estimates that underlying case volume growth for independents is in the 1.5% range, meaning the “Big 3” are gaining valuable “share of the street.”

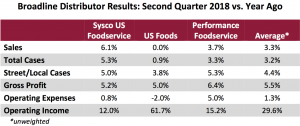

The quarterly results of the referenced distributors are summarized below, and they are generally positive. While the companies reported food cost inflation to be 1-2% (depending upon the product mix), comments made to analysts reflected a cautionary outlook due largely to growing cost headwinds primarily from rapidly escalating labor and freight costs. We believe the labor situation will cause many industry participants to make fundamental changes in their business practices.

At the time of their earnings release, US Foods announced the acquisition of Services Group of America, the parent company of Food Services of America and other distribution companies. We regard the move as strategically sound and expect it to provide US Foods with many significant financial and operational benefits.

For in-depth perspectives and insights into critical strategic issues regarding foodservice distribution:

REGISTER NOW!

REGISTER NOW!

SUMMIT 12/4/2018 | CHICAGO

FOODSERVICE DISTRIBUTION ISSUES, OUTLOOK AND IMPLICATIONS

Scheduled Speakers

| John Davie | CEO Buyers Edge Platform |

| Gene Clark | Owner/Partner Clark Associates and WEBstaurant Store |

| Stacie Sopinka | SVP Innovation & Quality US Foods |

| Pat Mulhern | President/CEO Distribution Market Advantage |

| Jerry Peacock | President Acosta Foodservice |

| Jack Carlson | Former VP UniPro Foodservice |