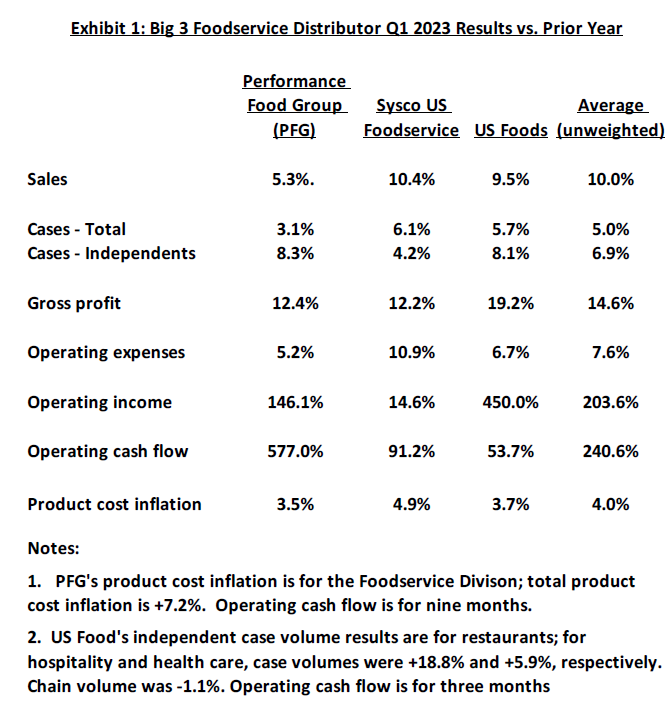

Performance Food Group (PFG), Sysco and US Foods (the Big 3) recently released their 2023 first quarter results. These results reflect several significant, generally favorable and rather interesting trends including, most notably, ongoing deceleration of product cost inflation1, a “normalization” of market growth, and evidence of an unexpectedly robust independent restaurant market.

In addition to total case growth of 5%, which is well in excess of Technomic’s “real” 2023 industry growth estimate of 3.2% (11% nominal)2, the Big 3 increased gross profit by 14.6% and operating expenses by 7.6%, which is indicative of improved customer and product mix, diversified portfolio and effective expense management. This being the case, the Big 3’s operating profit and cash flow were up sharply, which enables the companies to make strategic investments3, increase dividends and buy back their shares. The ability of the companies to grow gross profit faster than operating expenses provides them with very considerable “earnings” leverage.

Significantly, the Big 3 grew “independent/local” case volume by an average of 6.9% (and reported softness in chain volume). As noted, this implies that the segment is growing at a 15 – 16% nominal rate and/or that the Big 3 are gaining major share in that segment. If the latter is the case, we cannot discern with any certainty who the share “losers” are. We do not believe the regionals are ceding any share. Independent operator “mortality” spiked during the pandemic, with as many as 100,000 locations closing permanently. Most of those were weaker, older, undercapitalized locations pre-COVID. Consumer demand previously filled by those locations has since shifted to healthier operators, seemingly more so to strong, well-managed independents in adjacent geographies. Sysco has long claimed that its customer mix reflects a more successful and resilient operator population, and we suspect the same holds true for all three Big 3 foodservice distributors. Hence, we may be witnessing a share shift driven by customer quality more than quantity, which in turn may explain the better-than-industry-average case volume gains.

In previous POVs, we have commented on the impact menu price inflation (and high menu prices in general) – coupled with concerns about a slowing economy – will have on consumer behavior in most commercial foodservice venues. We are increasingly convinced that the situation has reached a “tipping point” and that the industry will experience reduced traffic, trading down, and lower check averages absent meaningful “corrections” (probably in the form of more promotional activity). The delivery business is already suffering in large part from consumers’ growing unwillingness to pay the delivery fee, tip and sometimes higher menu prices for the convenience of delivery. Price resistance will represent a growth challenge for all industry participants, including the Big 3, and will put a brake on the industry’s rebound and profit growth.

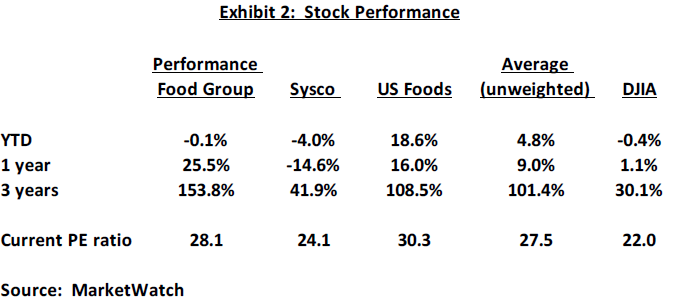

As a group and for the most part individually, the stocks of the Big 3 have outperformed the overall market (especially on a three-year basis) and are trading at a higher multiple. This indicates how positively investors view the relative performance of the companies and the fundamental attractiveness of the industry.

On the macro-economic front, we are not convinced that we will experience a recession or even a sharp contraction as demand and employment remain strong. However, we do believe that higher interest rates and tighter credit will pressure many industry participants. Given the financial strength, the Big 3 should be able to capitalize on any market weakness to improve their businesses and gain share.

1 In the first quarter of 2022, YOY inflation was 17.4%

2 January 2023 forecast

3 US Foods just announced the acquisition of Renzi Foodservice, a regional broadliner

By: Bob Goldin and Barry Friends