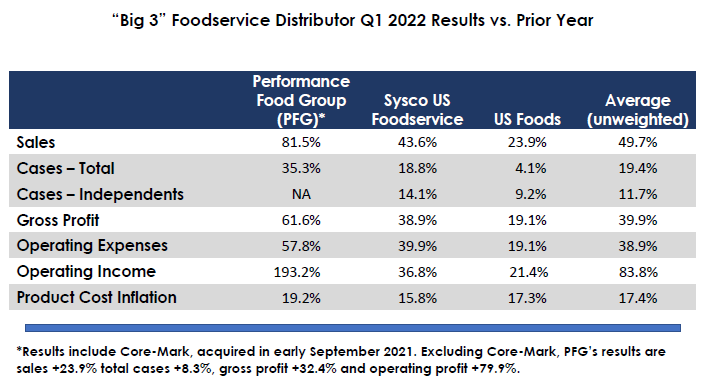

Like all other foodservice distributors, the “Big 3” broadliners – Performance Food Group, Sysco Corp. and US Foods – are facing a myriad of chronic and enduring challenges including record-high food cost inflation, product shortages, rising labor costs, the adverse impacts of Covid-19, and unpredictable consumer demand. Despite these serious headwinds, the “Big 3” continued to experience above market sales growth and improved profitability during the first quarter of 2022, as shown below. Excluding the recently acquired Core-Mark from Performance Food Group’s results, the “Big 3’s” sales were +30.5%, cases +10.4%, gross profit +30.1% and operating profit +46.0%. Chef’s Warehouse, the other publicly traded foodservice distributor that is heavily oriented toward the independent restaurant segment, had impressive results as well – sales were +82.8%, cases + 47.3% for specialty products and +26.9% (lbs.) for center of the plate, with major improvements in gross and operating profitability. We also wish to point out that Costco, which does $8 – 10 billion in foodservice volume, had same store comp sales growth (ex. fuel) of 11.3%.

The “Big 3” reported success in passing along inflation (which averaged a nearly unimaginable 17.4%) and efficiency gains. While consumers are facing painful cost increases (most notably in fuel and groceries) and government stimulus payments have been reduced significantly, foodservice has not been affected (at least not yet). On the contrary, distributors and other industry participants are benefitting by a massive demand surge and a robust recovery in formerly lagging segments, most notably travel and leisure. To date, most consumers appear to be price insensitive with respect to foodservice spending – the Bureau of Labor Statistics reports that menu prices are +7.2% vs. the prior year; anecdotally, the increase seems to be much greater. To that extent, distributors have not been negatively affected by the rampant food cost inflation.

Over the past several weeks, we have been in direct contact with leading regional, independent and specialty distributors and received generally consistent qualitative feedback on market conditions:

- Foodservice distributors have survived a “near death” experience (the pandemic) due to government relief and to “smart” moves they’ve made to reduce costs and increase efficiency. The operational enhancements have included SKU/vendor reduction, better routing, customer mix improvement, more “intelligent” sales force management, reduced/more prudent capital expenditures, selective headcount reductions and the like.

- Both P & L’s and balance sheets are much improved

- There have been virtually no distributor closures or bankruptcies

- For most distributors, sales dollars and operating profit margins are ahead of 2019; actual performance is dependent upon market and customer mix.

- The downtown sections of major metro areas are still sluggish, although improving.

- Certain markets like Florida and Arizona are “booming’

- Distributors are optimistic about their overall business prospects but do expect some “starts and stops” due to likely future Covid-19 outbreaks

- Supply chain issues (mostly inbound freight) are very troublesome and do not seem to be improving. Service levels from manufacturers are at historically low levels and are adversely impacting their ability to service their customers and grow their own brands.

- In response, when feasible, distributors are increasing their inventory levels

- Labor availability, retention and cost remain ongoing challenges with many reporting successes in improved labor management, albeit at broadly higher wages in warehouse and delivery positions

Under pressure from an activist investor group, US Foods announced a CEO transition and Board changes. The company will very likely accelerate margin enhancement initiatives to “narrow the margin gap” with Sysco, although we are not confident they will be able to do so in the near term, as we believe much of the spread is structural (especially sales mix). How this will affect US Foods stakeholders, including its suppliers, is not clear to us and bears close monitoring.

On a closing note, we wish to thank Pietro Satriano, the outgoing CEO, for his valuable and gracious support of our firm and to commend him for very impressive accomplishments while at the helm of US Foods.

By: Bob Goldin and Barry Friends