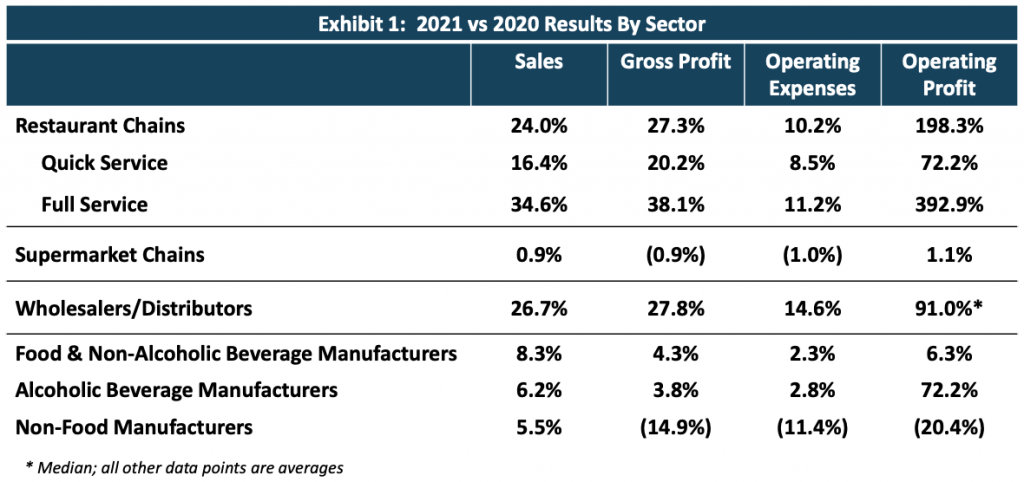

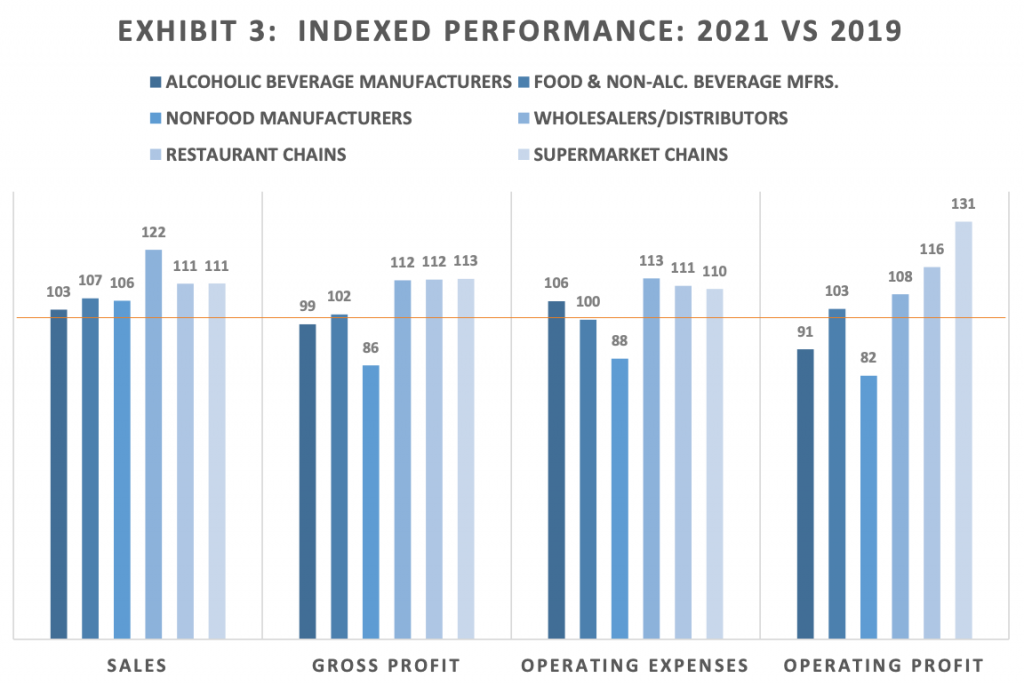

The food industry generally performed well in 2021, as foodservice demand substantially improved, and industry participants took concrete actions to mitigate the serious headwinds affecting product and operating cost increases and a host of unprecedented supply chain challenges. The industry continues to rebalance, and financial performance will remain varied across sectors and segments as participants address the continued challenges of these sustained forces. All sectors did experience sales growth in 2021, and, except for non-food manufacturers, improved operating profits. In all sectors, sales are ahead of 2019, as shown in Exhibit 3.

To determine how various sectors performed in 2021, Pentallect assessed the results of approximately 70 publicly traded companies in the following sectors¹. The data also show the profit margin differentials of the various sectors we studied².

- Quick and full-service restaurant chains

- Supermarket chains

- Wholesalers and distributors

- Food and non-alcoholic beverage manufacturers

- Alcoholic beverage manufacturers

- Non-food manufacturers

Our analysis revealed several interesting performance trends that are reflective of the market dynamics referenced above:

- As frequently noted, restaurant chains recovered from significant declines during the first year of the pandemic with average +24% sales growth and almost 200% operating profit growth despite rising labor and ingredients costs. Full-service restaurants, in particular, enjoyed a robust recovery in 2021.

- Supermarket chain performance flattened in 2021 after very solid pandemic-fueled growth in 2020, delivering an average +0.9% sales growth. The supermarket chains were generally able to offset rising inventory costs in 2021 by managing operating expenses to deliver slightly improved operating profits of +1.1%.

- The distributor/wholesaler sector delivered strong sales growth of +26.7% driven by the foodservice recovery and effectively managed operating expenses to deliver a +91% operating profit improvement.

- Food and beverage manufacturers, with the exception of non-foods manufacturers, delivered strong top-line growth supported by the foodservice industry recovery, mix improvements and price realization. Non-foods manufacturers were particularly hard hit by increased raw materials costs, which depressed profit margins.

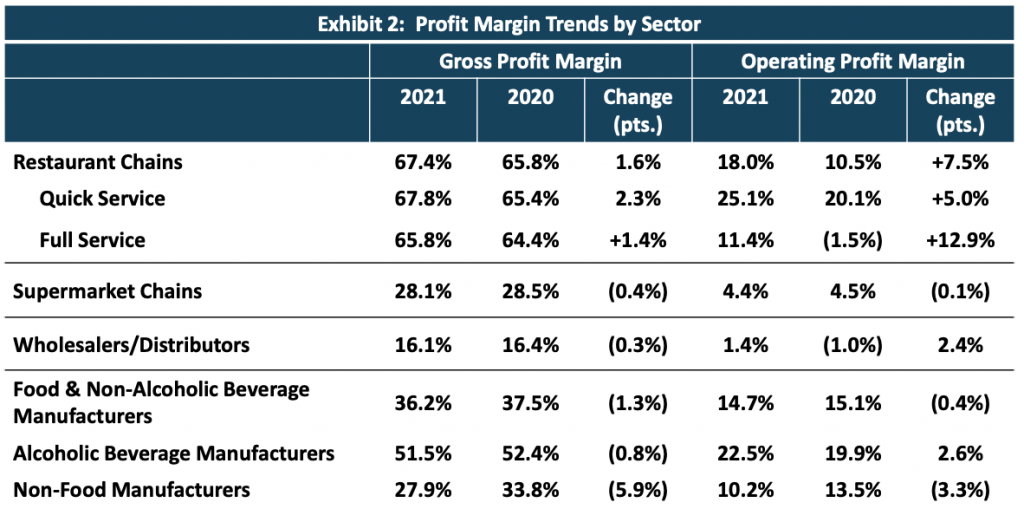

- As shown in Exhibit 2, restaurant chains were the only sector that was able to improve gross profit margins in 2021, while restaurant chainss, wholesalers/distributors and alcoholic beverage manufacturers were able to successfully manage operating expenses to achieve operating profit margin improvements.

Pentallect anticipates that the current inflationary environment will adversely impact food industry profitability in 2022 as consumers will likely resist continued price increases in the face of declining disposable income until inflationary pressures subside. These dynamics will particularly present risks for a sustained full-service restaurant sector recovery as many consumers will likely revert to lower cost retail and quick service restaurant alternatives; they may also tend to favor lower cost products and segments. As always, individual company performance will depend on their sector and customer portfolios and their ability to address the factors and trends noted above.

¹Results reflect total company performance, including international operations. In some cases, results are for a partial year

²Averages are unweighted

By: Bob Goldin and Rob Veidenheimer

Want to know more about how your company can take greater advantage of these and other significant trends? To speak with a Pentallect partner about opportunities for growth or meeting developing challenges: