By: Bob Goldin | Rob Veidenheimer and Bill Caskey

September 6, 2019

As our clients begin to plan for the upcoming year, we believe it is timely to provide our perspectives on what to expect. Our views are informed by extensive interface with important foodservice and retail trade sources, almost all of whom are decidedly pessimistic about the industry’s short-term prospects.

As our clients begin to plan for the upcoming year, we believe it is timely to provide our perspectives on what to expect. Our views are informed by extensive interface with important foodservice and retail trade sources, almost all of whom are decidedly pessimistic about the industry’s short-term prospects.

Overall expectations:

The food industry has not derived any significant boost from the generally strong economy. In foodservice, restaurant growth is almost entirely due to menu price increases (+3.2% vs. year ago¹) as traffic continues to decline. In retail, traditional segments, which are dominated by supermarkets and supercenters, continue to experience declines in center store volume and to lose share to nontraditional channels² like online, club stores and limited assortment stores.

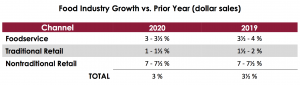

The food industry is facing a number of factors that will continue to adversely impact performance; paradoxically, some of these are due to the strong economy. As a consequence, we expect industry growth to decelerate in 2020, which will lead to further consolidation, margin pressures and a supply/demand rebalancing. In total, we project that food industry revenues will grow at 3%, while overall volume will be relatively flat. Nontraditional channels will be the major share gainer. Our preliminary forecast for 2020 is shown below:

Underlying our forecast are the following observations:

- There is a tremendous amount of uncertainty and frustration with government tax, trade, tariff and fiscal policies, leading to a loss in consumer confidence and a reluctance to spend or, at a minimum, more conservative spending patterns. Further, many – but certainly not all – economists are predicting an imminent economic slowdown of some severity.

- Labor shortages – most notably in transportation, warehousing and kitchens – are chronic in many major markets. They are causing very significant wage pressures and are negatively affecting operations (e.g., hours being curtailed).

- Wage pressures are forcing operators and retailers to raise prices in a price-sensitive environment where affordability (of restaurant meals) is a growing problem for many consumers. They are also causing them to evaluate and deploy robotics, ordering kiosks, self-service, and a wide range of other technologies to reduce staffing.

- Urbanization is increasing a wide range of providers’ operating costs such as occupancy. In a related vein, the travails of suburban malls (e.g., anchor store closures, traffic declines, forced re-concepting, etc.) is a serious headwind for the many restaurants, including many casual dining chains, that locate at or near the malls.

- Post-recession, restaurants – especially independents – have been opening at a fairly aggressive rate, resulting in an oversaturation situation that necessitates an (overdue but painful) correction, which we believe has commenced.

- Independent restaurants, fast casual, natural food stores and supermarket prepared foods have been leading growth segments, and, for different reasons, are all experiencing slowdowns. While a number of concepts like Chipotle are “defying gravity,” we anticipate that the slowdown will continue in 2020. Slower growth of independent restaurants is concerning for distributors as they represent their most profitable segment.

- Arguably, certain high-volume industry channels like full-service restaurant chains and traditional supermarkets are in secular decline.

- Delivery has been touted as a huge growth stimulant for restaurants and other food providers. For many, it is proving to be cannibalistic and margin dilutive, especially given the loss of high-margin beverage sales on most restaurant delivery orders. In addition, many of the leading third-party delivery services are unprofitable and will be forced to modify certain “pro-consumer” practices. Net, we believe delivery will continue to grow but at a much slower rate than heretofore and a number of operations will scale back or withdraw their involvement.

- Given the slow growth and intense competitiveness in both retail and foodservice channels, we will continue to see heavy and costly promotion activity, including value options, bundling, temporary price reductions, and so on in an effort to maintain or build traffic.

- The impact of certain longstanding demographic trends such as a rapidly aging population and smaller households are increasingly manifesting themselves to the detriment of the food industry.

While incumbent politicians are highly motivated to “stoke” the economy during an election year, we do not foresee that temporary pro-growth initiatives such as payroll tax cuts will stimulate “above trend line” growth.

Our clients are advised to continue to focus on efficiencies, consumer demand creation, strategic customer development, align resources and investments against priority segments and customers, and carefully measure ROI on core business practices such as marketing, capital spending and trade programs.

To continue the conversation on this topic and learn how Pentallect can assist in evaluating and enhancing your organization’s strategic growth plan, please:

¹Source: Bureau of Labor Statistics

²Nontraditional channels include club stores, limited assortment stores, online, specialty stores, meal kits and the like.