by: Bob Goldin | Rob Veidenheimer

July 2, 2018

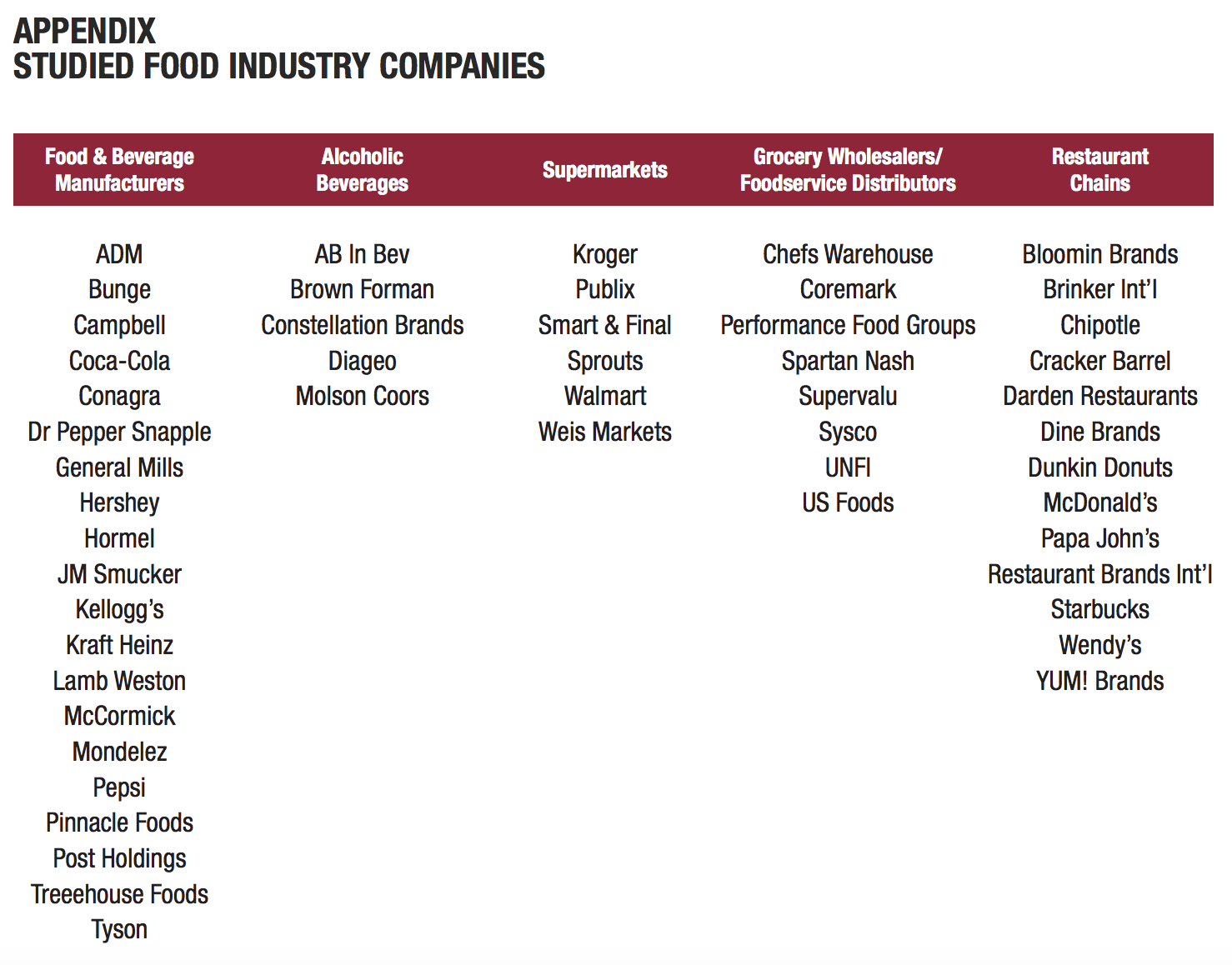

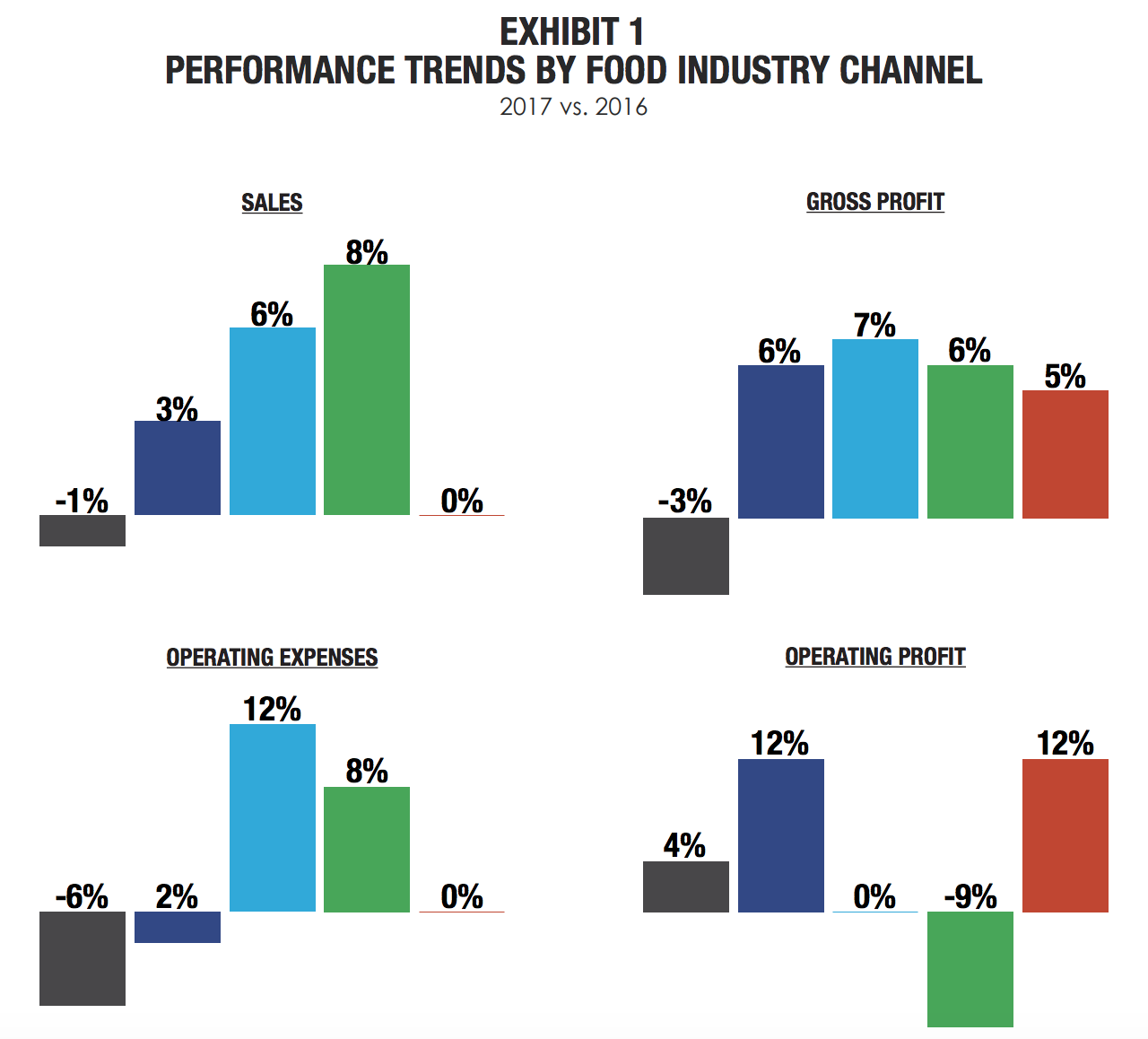

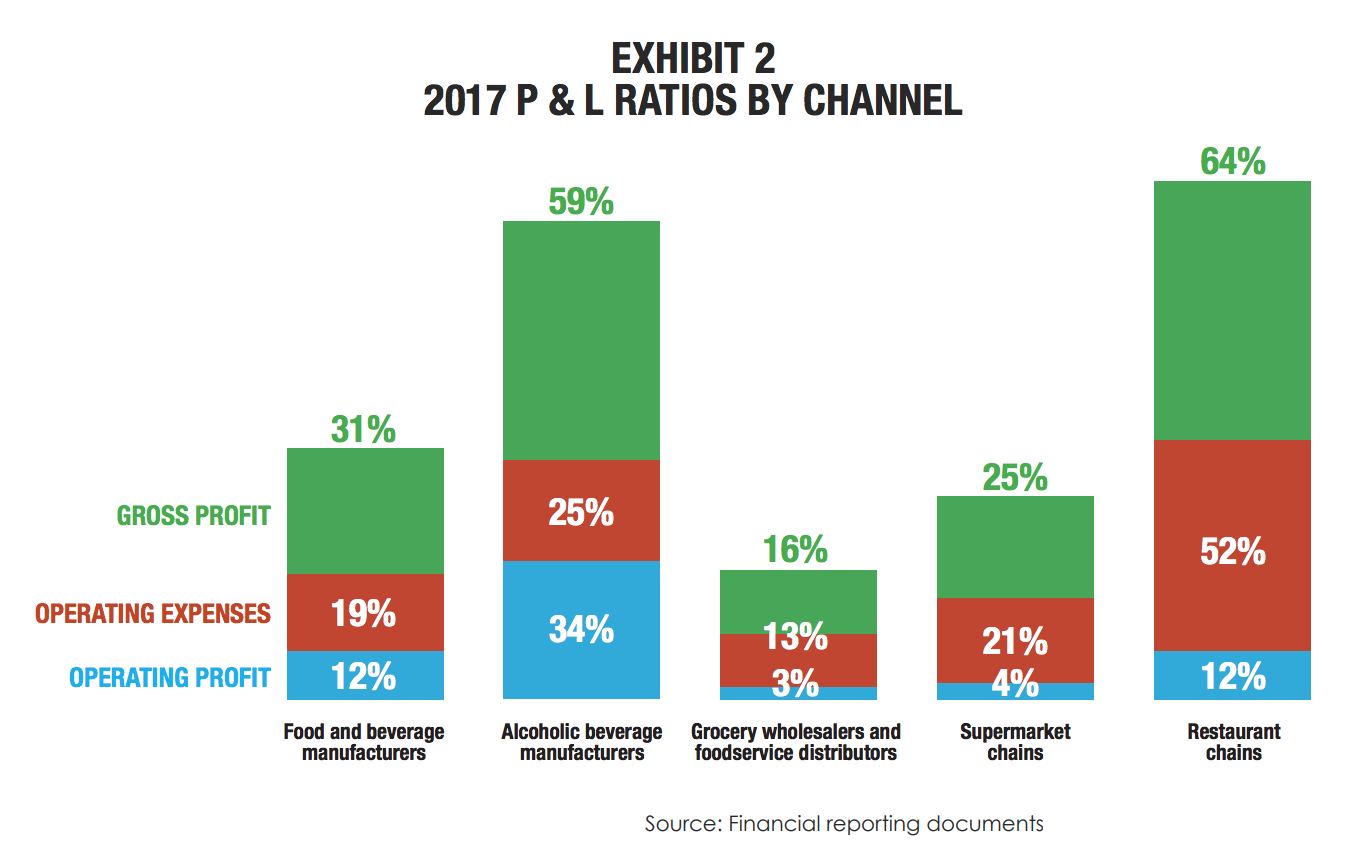

Pentallect has thoroughly analyzed the recent sales and profit performance of over 50 publicly traded food companies that operate in all major industry channels – food and beverage manufacturers, alcoholic beverage manufacturers, grocery wholesalers, foodservice distributors, supermarket chains and restaurant chains (see Appendix for list of companies). Our analysis focused on trends in sales, gross profit, operating expenses and operating profit from 2017 vs. 2016. We have also compiled representative P & L statements for channel participants (see Exhibit 2). We used simple averages to avoid having very large companies “distort” the results.

Pentallect has thoroughly analyzed the recent sales and profit performance of over 50 publicly traded food companies that operate in all major industry channels – food and beverage manufacturers, alcoholic beverage manufacturers, grocery wholesalers, foodservice distributors, supermarket chains and restaurant chains (see Appendix for list of companies). Our analysis focused on trends in sales, gross profit, operating expenses and operating profit from 2017 vs. 2016. We have also compiled representative P & L statements for channel participants (see Exhibit 2). We used simple averages to avoid having very large companies “distort” the results.

FOOD AND BEVERAGE MANUFACTURER TRENDS

Food and beverage manufacturers are clearly facing the most significant headwinds, resulting in sales and gross profit declines of 1% and 3%, respectively; 50% of the studied companies reported sales declines. For multinational companies, North American sales were off even more sharply (-3% vs. +2% for international sales). Producer prices rose 2% in 2017, suggesting unit volume declines of -5% in North America. Operating profit was up due to a decrease in operating expenses, especially in the SG & A area. In the near term, we expect to see continued cost reductions and acquisitions, although acquisitions have generally failed to stimulate revenue performance as the acquired companies lack scale, pose integration challenges, often suffer diminished brand cachet and customer appeal when associated with “Big Food” and a number of other factors. To succeed moving forward, manufacturers will be required to swing the pendulum back to investment in brand building activities and focused go-to-market strategies, including development of new channels, that drive organic top-line performance off the more streamlined operating infrastructures.

ALCOHOLIC BEVERAGE MANUFACTURER TRENDS

Alcohol beverage manufacturers fared somewhat better, with sales and gross profit increases driven primarily by price increases and mix improvements, and a 12% operating profit gain driven by sales growth and lower operating expenses. As with food and beverage companies, international markets grew faster than North America.

GROCERY WHOLESALER/FOODSERVICE DISTRIBUTOR TRENDS

Paced by Sysco, UNFI, Chef’s Warehouse and Coremark, the grocery wholesaler and foodservice distributor channel had much more robust sales growth, averaging 6%. However, the benefits of the top-line improvement did not lead to operating profit growth due to higher operating expenses.

SUPERMARKET TRENDS

Supermarkets had very solid sales growth, averaging 8%. Gross profit performance slightly lagged sales growth at 6% due primarily to product mix and cost-of-goods inflation that was not fully passed on to consumers. Operating expenses rose in line with sales. The rising operating expenses in combination with the gross margin growth gap relative to sales drove operating profits down -9%.

RESTAURANT CHAIN TRENDS

Restaurant chain performance was a “mixed bag,” with 54% of the companies showing sales growth and 46% showing a decline. (Restaurant company sales reflect company owned stores and franchisee fees). Gross profit was +5%, which can primarily be attributed to mix enhancements and improved price realization as opposed to traffic gains. Solid, double-digit operating profit growth at Bloomin’ Brands, Chipotle, Cracker Barrel and McDonald’s helped boost the channel average operating profit growth.

Going forward, we anticipate that participants in all channels, especially the larger, established companies, will be challenged to maintain their profit margins in the absence of meaningful sales growth. Operating expense reduction and consolidation will be the primary operating profit enhancement strategies while international expansion, new channels and highly targeted go-to-market models will be the primary revenue growth drivers.

Please contact us if you would like to review our findings and discuss implications in greater detail.