by: Bob Goldin | Barry Friends

November 8, 2018

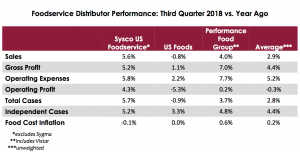

As illustrated, the three largest foodservice distributors have each experienced year-over-year operating expense increases that are negatively affecting their profit growth. The cost increases are due to higher fuel and labor, and the cost pressures are expected to intensify going forward as labor supply further tightens. To complicate the situation, we believe the chronic driver (and, to a slightly lesser extent, warehouse selector) shortage will be an intractable industry problem that will lead to major changes in supply chain practices up and down the entire value stream.

As illustrated, the three largest foodservice distributors have each experienced year-over-year operating expense increases that are negatively affecting their profit growth. The cost increases are due to higher fuel and labor, and the cost pressures are expected to intensify going forward as labor supply further tightens. To complicate the situation, we believe the chronic driver (and, to a slightly lesser extent, warehouse selector) shortage will be an intractable industry problem that will lead to major changes in supply chain practices up and down the entire value stream.

Regarding the most recent quarter, we observe the following:

- Sysco, US Foods and Performance Food Group continue to be highly effective in growing their independent restaurant volume as evidenced by their impressive independent case volume growth, especially with their very profitable private brands. We believe the independent market is beginning to slow down, which may inhibit the distributors’ growth trajectory to some degree.

- Distributors generally “like” some (but not too much) inflation, and they are now operating in a virtually no inflation environment (and are seeing deflation in a number of major categories like proteins). We expect the trade wars and tariffs to put downward pressure on many food categories so distributors are unlikely to see any near-term benefit from inflation.

- Sysco’s U.S. Broadline Division (+5.6% as shown above) is significantly outperforming its International and Sygma Divisions (International was +0.6% and Sygma -1.2%). Performance Food Group now details two Divisions – Foodservice (Broadline and Customized) and Vistar; the latter was +12.0% vs. 2.2% for Foodservice).

- The market responded positively to the earnings releases from US Foods and Performance Food Group most likely due to their increase in gross profit per case; their stocks were +13% and +10% the day the earnings were released.

While the economy is a clear boon to the foodservice industry, distributors will be challenged by rising operating expenses that will necessitate even greater focus on efficiencies and cost management. At the same time their operator customers are struggling with severe labor-related cost pressures that often translate to increased scrutiny of COGS and related distributor pricing. Minimum wage referenda recently approved in historically low-wage states are a sign of further cost pressures that the industry will face.

To hear the latest and most provocative thinking about foodservice distribution, don’t miss Pentallect’s “Distribution Summit” next month in Chicago. See details below.

REGISTER NOW!

SUMMIT 12/4/2018 | CHICAGO

FOODSERVICE DISTRIBUTION ISSUES, OUTLOOK AND IMPLICATIONS

Scheduled Speakers

| John Davie | CEO Buyers Edge Platform |

| Gene Clark | Owner/Partner Clark Associates and WEBstaurant Store |

| Stacie Sopinka | SVP Innovation & Quality US Foods |

| Pat Mulhern | President/CEO Distribution Market Advantage |

| Jerry Peacock | President Acosta Foodservice |

| Jack Carlson | Former VP UniPro Foodservice |