Despite a resurgence of COVID-19, ongoing access restrictions, severe labor and product shortages affecting all trading partners and rapidly escalating (and alarmingly high) menu prices, consumer demand for foodservice continued to be robust, which fueled strong performance, especially on the top-line, by the “Big 3” foodservice distributors (Performance Food Group, Sysco Corp. and US Foods). In their most recent earnings calls, the referenced companies stated that they are outpacing the market, leading to share gains, and successfully passing along sequentially higher product cost inflation (which averaged a nearly unprecedented 13.8% in the fourth quarter of 2021). Excluding Core-Mark in Performance Food Group’s numbers shown in Exhibit 1, the “Big 3” average sales were +31.9% and total case volume was +14.8%. The sales and case volume growth are particularly impressive considering the softness in the independent full-service restaurant segment, especially in heavily populated Northeast, Midwest, and West coast markets. Equally encouraging, Sysco’s International Division continued to recover, with sales +42.6% and a return to profitability.

To varying degrees, the “Big 3” are effectively employing strategic initiatives focused on:

- Hiring/retention

- Supplier management

- Private brands

- Customer mix improvement

- Price optimization

- Business simplification, including SKU rationalization

- US Foods reported a 15% reduction in assortment

- Standardization and automation

- (Some) deleveraging

- M & A

- During Q4, Performance Food Group acquired Merchants Foodservice and Sysco announced the acquisition of the Coastal Companies¹ and Paragon Foods, fresh produce distributors

- The “Big 3” (especially Sysco) continue to be active, with the emphasis on fill-ins and horizontal development

- In- and out-bound logistics optimization

- We expect the “Big 3” to actively engage in major efforts to reduce cost-to-serve, including network reconfiguration

- Specialty segment and category development

- Sysco reported “doing well” with its recent acquisition of Greco & Sons, a major Italian segment specialty distributor

- In 2021, Performance Food Group dramatically expanded its convenience store presence with the acquisition of the $17 billion Core-Mark, which has been combined with Eby-Brown to create a Convenience Division². Going forward, Pentallect plans to report on the Performance Foodservice Division.

- Assured supply/product availability

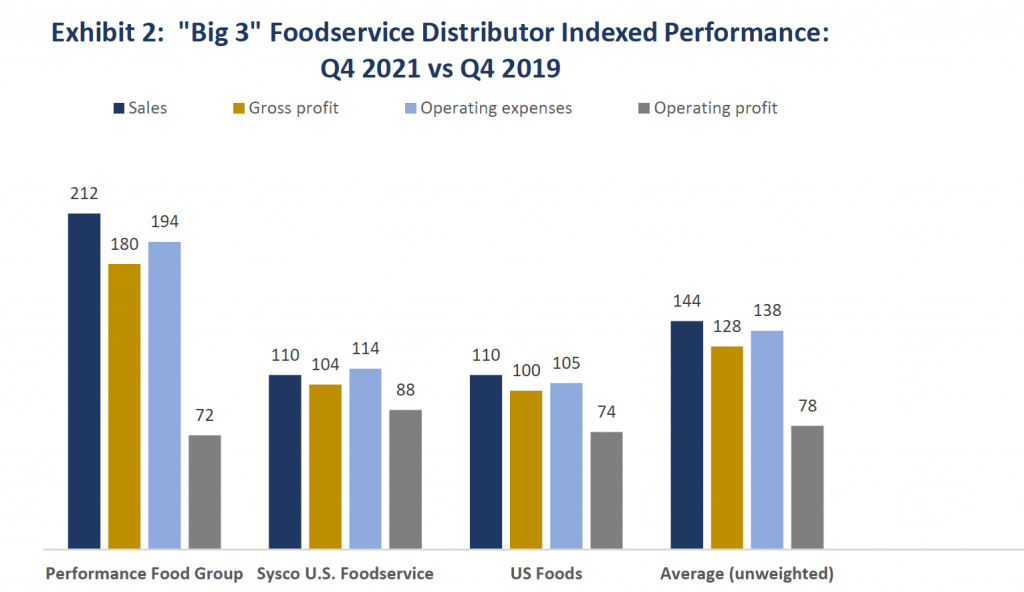

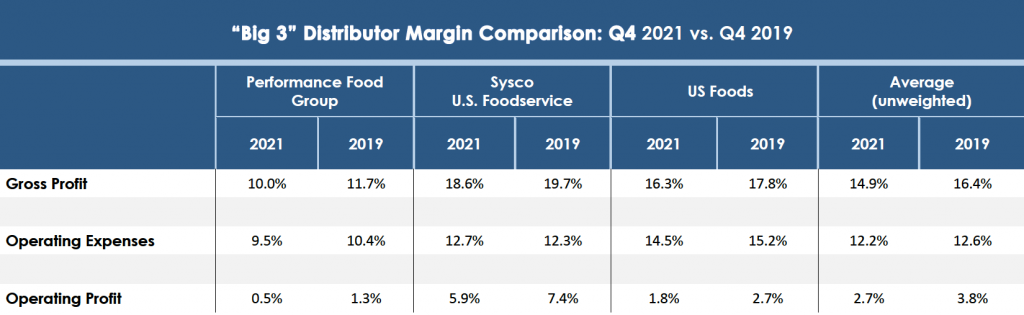

As illustrated in Exhibit 2 below, the “Big 3” are ahead of base period (Q4 2019, pre-COVID) sales and gross profit but are lagging in operating profit. On an unweighted basis, average gross and operating profit margins have declined by 150 and 110 basis points, respectively (ref. Exhibit 3). The shortfall is attributable to lingering cost headwinds and pandemic-induced declines in high margin segments, most notably independent restaurants. As the “Big 3” are all engaged in transformative operations enhancement programs, we fully expect their operating profits to improve fairly rapidly once the industry more fully recovers.

While the first quarter of 2022 is likely to show some adverse effects of Omicron and persisting inflationary pressures, it does appear that the foodservice industry is in a sustained recovery mode. Anecdotally, other large (non-public) distributors are faring well, which raises the question of which distributors are losing market share. Regardless of that difficult-to-ascertain answer, it is fair to say that the “Big 3” will be prime beneficiaries of a continued return to pre-pandemic foodservice volumes.

¹Completed in February 2022

²The company’s other Divisions are Performance Foodservice and Vistar

By: Bob Goldin | Barry Friends