By: Bob Goldin | Barry Friends and Bob Planck¹

February 13, 2020

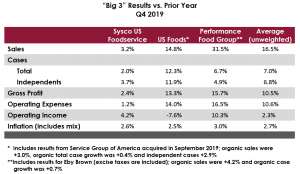

The “Big 3” publicly traded foodservice distributors – Sysco, US Foods and Performance Food Group – have again reported impressive results for the most recent quarter. For the group, sales were +16.5% and cases +7.0% on average, which is far in excess of industry performance. However, the results were significantly and positively impacted by recently completed acquisitions (most notably, US Foods’ acquisition of Service Group of America (completed in mid-September 2019) and Performance Food Group’s acquisition of Eby Brown (completed in April 2019))². Organic (underlying) sales and case volumes grew at a far more modest 3.5% and 0.8%, respectively. These organic growth figures are in line with Pentallect’s estimate of industry performance³. Operating expenses – which include many acquisition related costs and increased labor and freight – are outpacing gross profit growth, a problematic situation to say the least.

The “Big 3” continue to report continued strong growth in the independent operator segment with case volume growth of 6.8% (3.5% organic). This growth contributes significantly to improved profitability and reflects share gains vs. competition. On earnings calls, each of the “Big 3” companies indicated that independents will continue to be a key growth segment. Chef Warehouse, the other publicly traded foodservice distributor, also successfully focuses on higher end independents.

With the “Big 3’s” share (inclusive of their customized divisions) having expanded to 35%, such robust growth leads one to ask where the share gains are coming from? Or, in other words, who is losing share?

To the surprise of many, Sysco announced a major senior leadership change on January 13, 2020. A new CEO and lead independent director were appointed. According to the company, the change was enacted to “accelerate performance, fully capitalize on its scale advantages and drive meaningful operating improvements.” While we do not know what specific course corrections and/or strategic redirection will occur, we expect them to be fairly consequential as Sysco is clearly seeking to improve its growth trajectory.

As we look ahead to 2020, Pentallect expects the consolidating and concentrating foodservice distribution industry to remain a hotbed of merger and acquisition activity as companies seek to increase their scale. We also expect distributors to focus even more intensely on operating cost improvement, deleveraging and new operating models, including omnichannel approaches like US Foods is doing with its Direct, Pronto and Chef Stores businesses.

As we have previously and frequently discussed, exclusive brands are a core foundational growth and differentiation strategy for the “Big 3.” These companies already derive over half their gross profit from their exclusive brands and that share will increase as they continue to build scale and exclusive brands outperform the rest of the portfolio by a factor of 2 – 3.

¹ Bob Planck, a valued Pentallect affiliate, is the founder and former CEO of Independent Marketing Alliance (IMA)

² Performance Food Group completed its acquisition of Reinhart Foodservice on December 30, 2019.

³ Year-over-year (YOY) comparisons will also be deeply affected in 2020.

Pentallect will be issuing a comprehensive, first-of-its-kind report on

food and beverage brand dynamics, entitled: