In the absence of inflationary tailwinds, each of the Big 3 foodservice distributors – Performance Food Group, Sysco and US Foods – reported very solid growth in revenues, volume and profitability. They showed marked improvement in virtually all key operational and profit metrics, including gross profit per case, margin expansion, operating expense ratio, free cash flow, leverage and the like.

The Big 3 enjoy the huge benefits of size, financial muscle, a broad and deep product portfolio and customer diversification, including, in Sysco’s case, a large and improving international business. The companies have been aggressively adding account-facing personnel, better aligning their compensation with their strategic objectives, enhancing their technology capabilities, improving employee retention, winning new business, reducing leverage, and making accretive acquisitions[1].

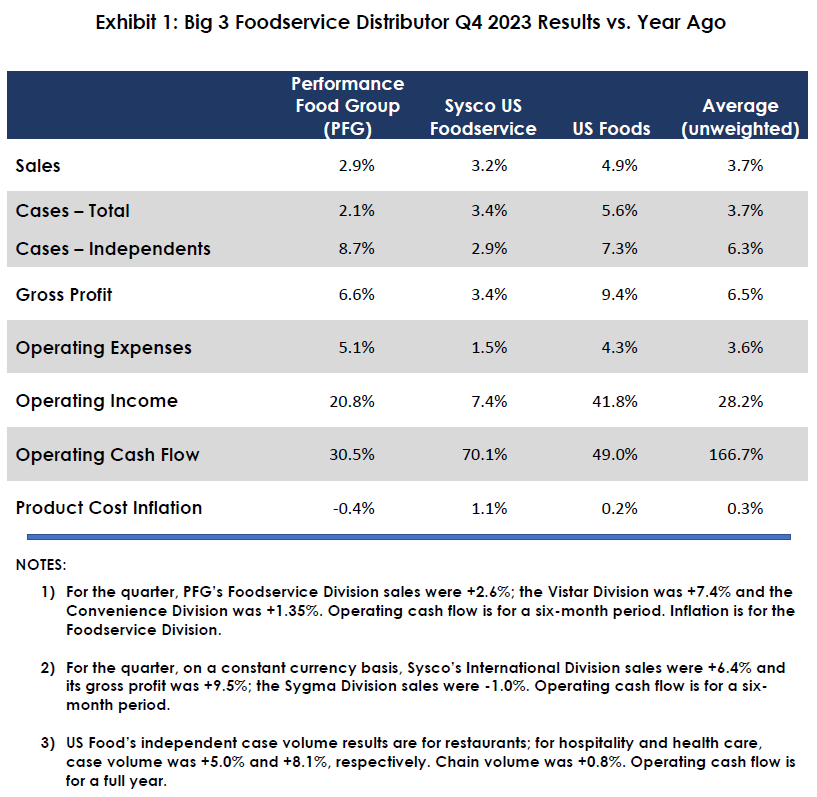

As shown in Exhibit 1, the Big 3’s gross profitability increased at a far greater rate than their operating expenses, providing them with significant operating leverage. They have used this leverage to fund strategic investments, share buybacks and dividend increases.

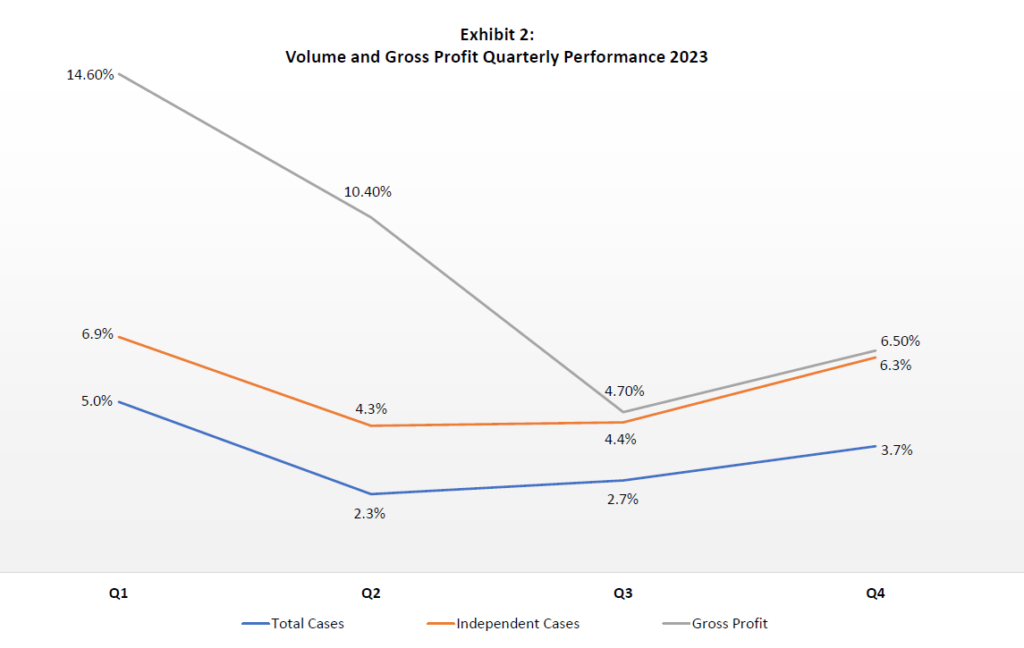

What is perhaps most impressive about the Big 3’s results are their independent case growth, which was +6.3% for the quarter and averaged +5.5% for the year. As we have often noted, this is the most profitable segment for broadline distributors and growth in this segment is a disproportionately significant profit contributor.

The Big 3’s independent case growth appears to far exceed the independent market growth; it also suggests that the independent market (and the overall market too) may be growing faster than many analysts report since we are not aware of any fundamental shift in market composition and shares.

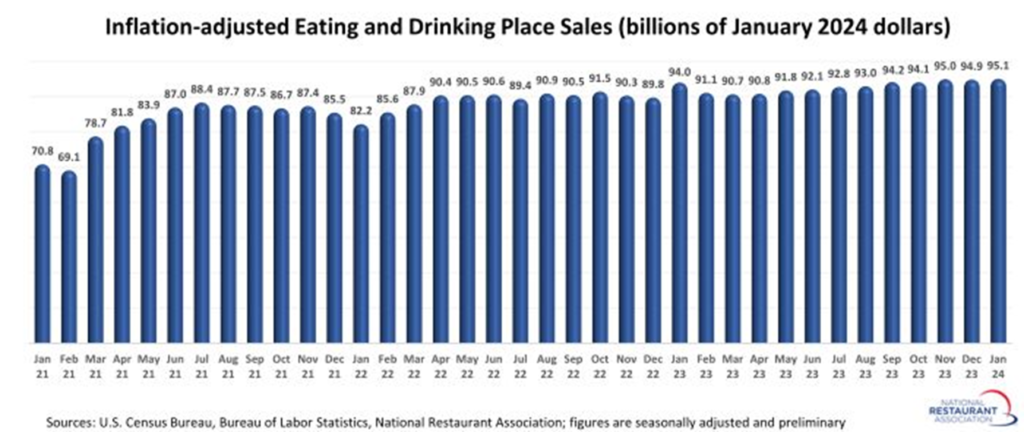

The Big 3 company officers report outperforming the overall market, the net result of which are share gains. And while “the numbers are clearly the numbers,” our visibility to the wider industry and specifically super-regional and other foodservice distributors begs the question of where these share gains are coming from. In other words, who is losing market share, if any, to the Big 3? Various syndicated data sources cite reduced consumer traffic at foodservice outlets (samples are predominantly chain restaurant based). At the same time, the Census Bureau and the National Restaurant Association have been reporting steadily but modestly growing inflation-adjusted industry volumes (see chart).

We are confident that the following foodservice types of distributors are retaining, if not gaining real market shares:

- Customized (systems) distributors (e.g., Martin Brower), especially those servicing major quick service restaurant chains

- Club stores and cash-n-carry

- Major regional broadline distributors (e.g., Ben E Keith)

- Multi-branch produce, nonfood, and protein specialty foodservice distributors

- E-commerce (most notably Webstaurant Store)

All that remains to be shrinking are the thousands of very small distributors and jobbers whose share, while meaningful, has never been dutifully quantified. What we know, however, is that there is not much crossover between the “micros” and the Big 3 due to the nature of their respective clientele. So, while the giants could, in theory, be gaining share at the expense of smalls, we do not see it. Since we are not aware of any fundamental shift in market composition and shares, we posit that the independent market (and the overall market too) may be growing faster than many analysts report.

What is clear is that the Big 3 have solid momentum. For aligned suppliers, this is “good news” as they will be able to “ride the wave.” Other suppliers may be challenged to find equally viable options for broad market reach.

By: Bob Goldin and Barry Friends

[1] US Foods just announced the acquisition of IWC, a $200 million Cookeville, TN based broadline distributor