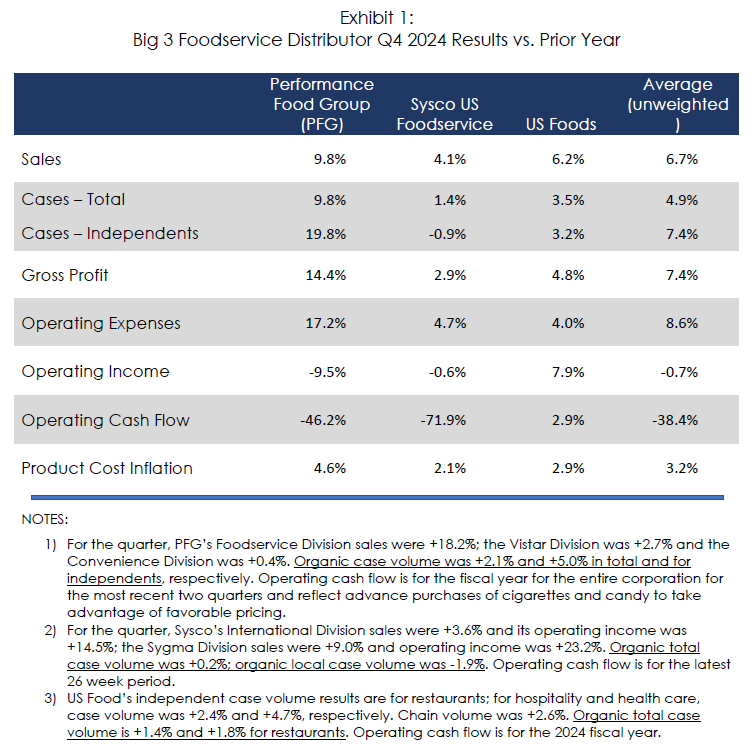

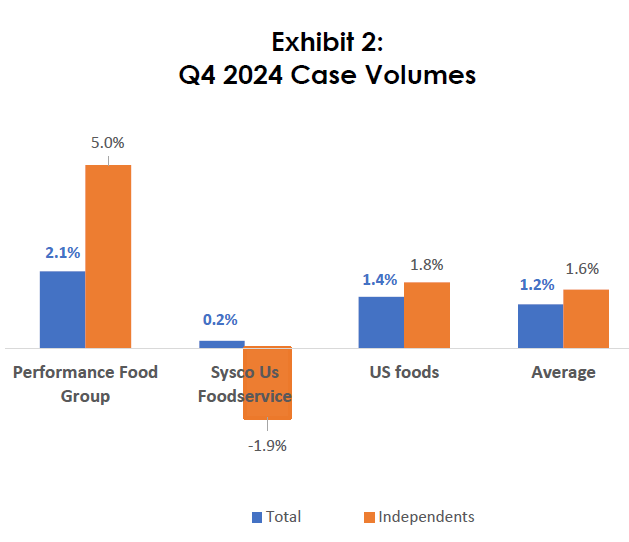

As a group, the Big 3 foodservice distributors achieved sales, case volume and gross profit growth during 2024’s fourth quarter. However, the solid reported performance was positively impacted by mergers and acquisition, most notably Performance Food Group’s $2.1 billion purchase of Cheney Brothers, which closed in early October 2024. As shown in Exhibit 2, organic case volume growth for the Big 3 was +1.2% in total and +1.6% for independents. Insofar as restaurant traffic was -1.6%, independent case volume growth of +1.6% suggests that the Big 3 are achieving their frequently cited strategic objective of growing share in that desirable segment. But, organic case volume growth is slowing a bit, reflecting a somewhat sluggish market.

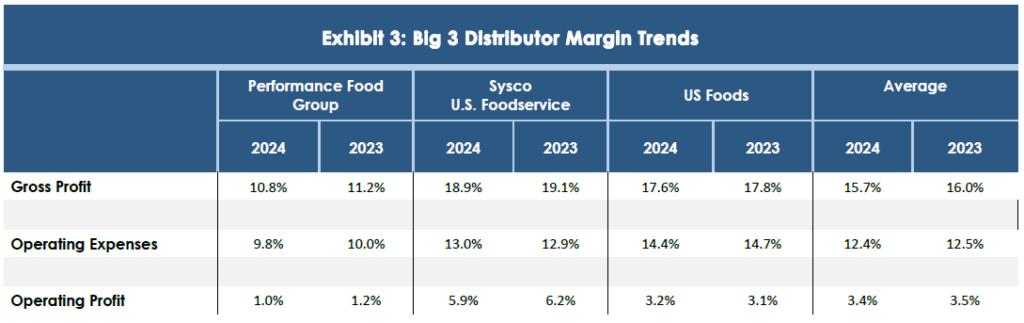

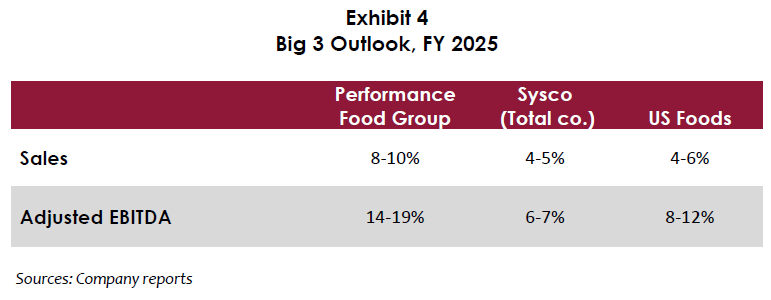

While the Big 3 did improve gross profit per case, as they have in recent quarters, we note that their operating expenses rose faster than gross profit, which puts a damper on operating income growth. Like other industry participants, the Big 3 are facing (possibly intensifying) headwinds from labor cost increases, food cost instability, empowered and stressed customers, challenging weather/climate patterns, and higher operating costs including insurance. Anecdotally, our senior distributor contacts express concern about Avian flu, lingering inflation and potentially disruptive government policies (e.g., tariffs). This suggests that the Big 3’s ability to achieve their stated revenue and profit objectives for 2025 (see Exhibit 4) will require intense strategic focus, operational excellence and favorable demand-side conditions.

The Big 3 are highly resilient companies with huge scale, excellent facilities, top-tier and deep management, broad product lines, key supplier relationships and diverse, “best of the best” customers. They have been highly effective in capitalizing on the market instability and supply chain disruptions caused by Covid and other factors (i.e., slow normalized market growth) to gain share of market, have made accretive and prudent acquisitions, improved many KPIs, and returned money to shareholders via share repurchases (and, in Sysco’s case, dividends). However, recently they are experiencing predictable challenges in increasing their margins, implying that improvement in profitability will likely focus on top-line growth.

We remain optimistic about the prospects for the Big 3 as they are uniquely advantaged. We do believe, however, that absent any major market accelerant, that their growth will be relatively modest.

By: Bob Goldin and Barry Friends