by: Bob Goldin | Rob Veidenheimer

April 11, 2017

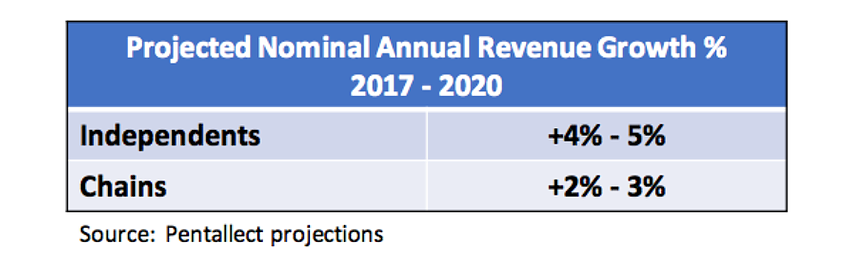

Recently, Independent restaurant traffic and revenue growth has outperformed chains. This dynamic represents an important shift from historical patterns when chains were driving industry growth fueled by unit expansion, menu innovation, daypart expansion, aggressive price discounting, financial wherewithal and the utilization of technology such as take out, consumer-direct marketing, and POS systems (to improve operating performance). This shift to independents has significant implications for manufacturers, sales agencies and distributors, as Pentallect projects that Independents will continue to outperform chains for the balance of the decade.

Recently, Independent restaurant traffic and revenue growth has outperformed chains. This dynamic represents an important shift from historical patterns when chains were driving industry growth fueled by unit expansion, menu innovation, daypart expansion, aggressive price discounting, financial wherewithal and the utilization of technology such as take out, consumer-direct marketing, and POS systems (to improve operating performance). This shift to independents has significant implications for manufacturers, sales agencies and distributors, as Pentallect projects that Independents will continue to outperform chains for the balance of the decade.

What is Driving this Shift?

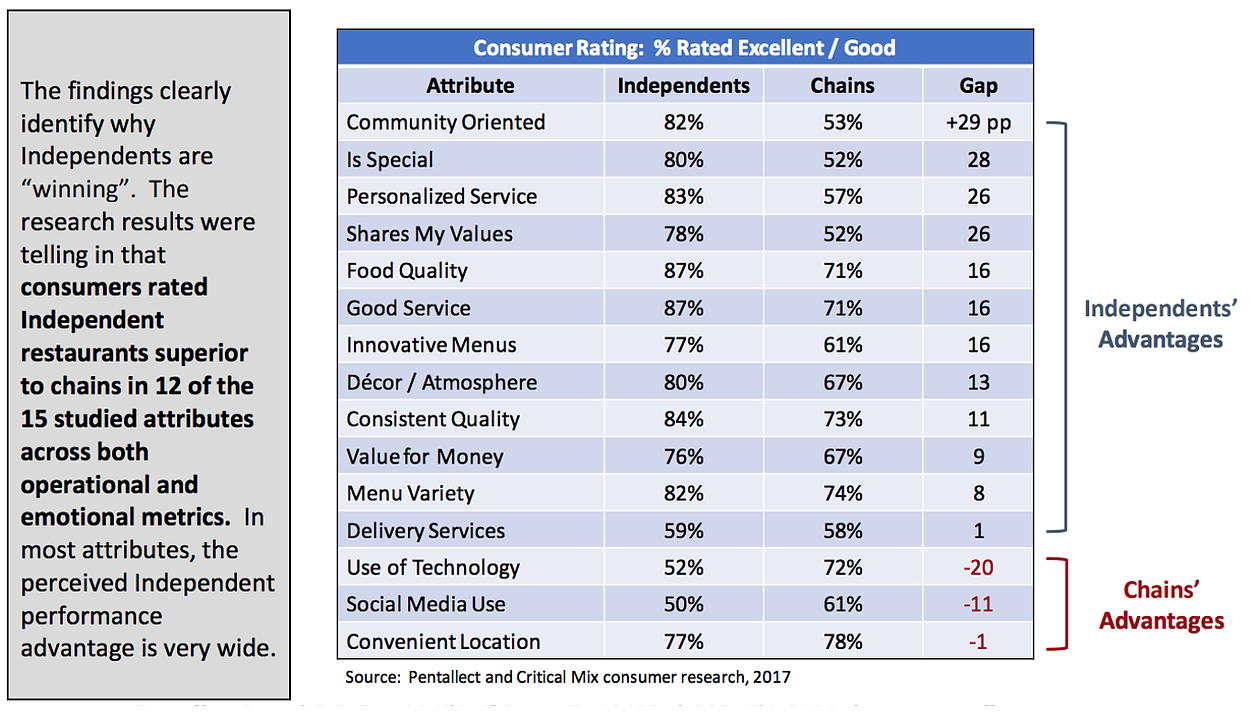

In collaboration with our research partner Critical Mix, Pentallect conducted in-depth research to better understand consumer attitudes regarding Independent versus chain restaurants on critical performance attributes. The research explored consumers’ perspectives regarding both restaurant operational metrics (food quality, service, value for the money, menu variety, etc.) as well as their emotional connections to restaurants (community orientation, décor/ atmosphere, shared values, etc.).

While it is not surprising that Independent restaurants are viewed as being superior on some of the more emotional attributes, independents are also outperforming chains on many of the key operational metrics including food quality, service, value and menu innovation. Based on the research findings, chain restaurants are only truly outperforming Independents with their use of technology and social media. This combined set of favorable attributes represents a significant advantage for well-managed Independents, and overcoming the perceived gap represents a major challenge for chains.

What is the Chain Restaurant Response?

Chain restaurant organizations are recognizing the growth challenges they are experiencing, and many are taking actions to either improve their financial performance or are pursuing exit strategies. In our view, the result will be a continuation of much needed consolidation within the restaurant sector, and increased focus on performance improvements versus unit growth. Recently, we’ve seen:

• Panera Bread being sold to investment firm JAB. Long an industry success story, the Panera sale suggests that the company sees itself evolving from a growth trajectory to a more mature financial / operational management phase, where it can sell at a high point and leverage the greater purchasing power and support service efficiencies within the broader JAB portfolio.

• Investment firm 3G’s purchase Popeye’s, which it clearly views as an opportunity to improve already solid margins within 3G’s Restaurant Brands International business unit.

• Bob Evan’s Farms decision to sell the restaurant business to private equity firm Golden Gate Capital, where the focus will be on increasing margins and improving operating performance.

• Darden’s acquisition of Cheddar’s to drive growth, operating efficiencies and potentially leverage Cheddar’s “scratch” positioning to address consumers’ food quality perceptions of chains.

What are the Implications?

While restaurant growth fundamentals have evolved, with Independent operators seizing sustainable momentum, most manufacturer and sales agency go-to-market models and financial resources remain constructed to overly support chains and contract accounts at the expense of Independents. How to effectively reach the thriving independent market, especially Local Leverage Operators (LLOs), remains a critical structural and strategic issue that must be addressed. For distributors, the profitable Independent segment represents an opportunity to bolster margins while driving growth. Distributors are recognizing this opportunity after years of prioritizing chain / contracted business to drive top-line growth, and are utilizing internal data and strategic incentives to focus greater resources (direct and sales agencies) against key Independents.

Certainly, chain restaurants, which account for well over one-half of all restaurant sales, require continued support, yet the issue is one of balance, as the consumer fundamentals driving Independent restaurant growth are likely to continue and even possibly accelerate over the next several years.

The imperative is to assess how to balance resources and build processes to effectively identify and align with leading Independents. This entails a thorough review of go-to-market strategy, analytical capabilities, planning processes and resource allocation.