August 26, 2021

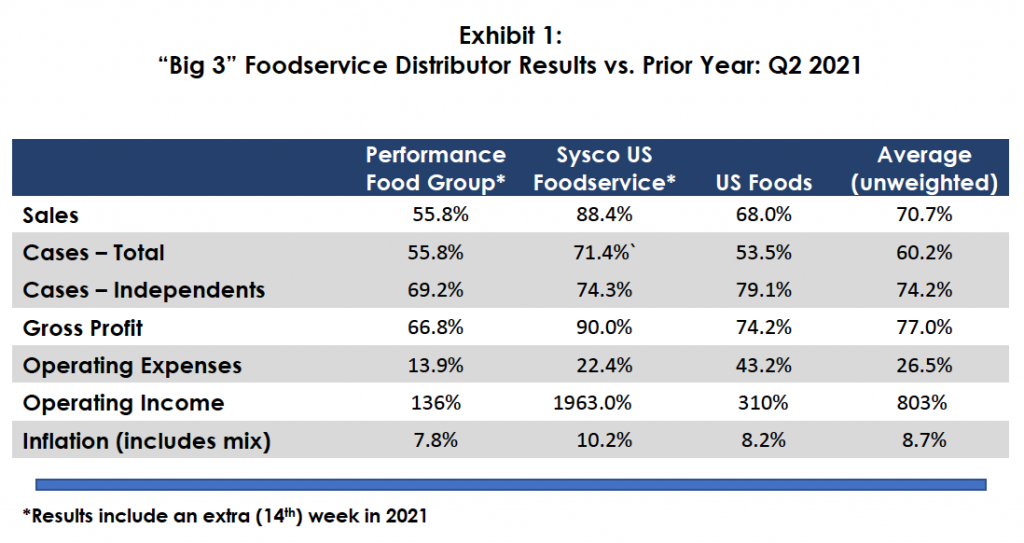

Paced by the restaurant segment, the foodservice industry is experiencing an unexpectedly strong recovery in the face of major labor and supply chain challenges, rising menu prices, and an unfortunate and alarming increase in Covid-19 cases. The most recent quarterly results of the “Big 3” foodservice distributors clearly demonstrate sharply improved top- and bottom-line performance, with average sales +70.7%, cases +54.7% and gross profit +77.0%¹. Sysco also reported improvement in its Sygma and International Divisions (not analyzed below).

Impressively, the companies demonstrated highly effective operating expense management, as operating expenses grew by 26.5%, about 1/3 the rate of gross profit growth. Given their scale, this pattern provides massive earnings leverage. Of note is the reported growth in independent case volume of +74.2% reflective of the underlying rebound independents are experiencing as restrictions are relaxed and of the “Big 3’s” ongoing focus on building share in this segment.

The studied companies reported almost 9% inflation, far greater than historical rates. They acknowledge success in passing along the increases to their customers, at least for now. In this supply constrained environment, operators appear to be most concerned with consistent product availability and less so with price. Somewhat to our surprise, consumers seem to be fairly price insensitive with respect to restaurant meals and other related leisure/entertainment activities. The duration of this pattern is an open question with potentially important implications on our industry; some observers contend that we are in a “bubble” that is not sustainable while others think otherwise. Pentallect believes that consumer spending for food away-from-home will remain elevated for the next 6 – 12 months due to deep-seated pent-up demand but will “normalize” thereafter.

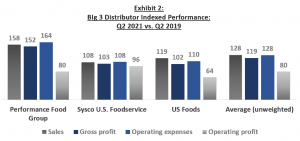

The foodservice distribution industry will contract by 8 – 10% from 2019 – 2021. As shown in Exhibit 2, during this time, the “Big 3” have grown by 28% (the growth includes acquisitions, of which there were several consequential ones completed), meaning they have outperformed the market and gained share. As we have discussed in previous analyses, this is due to their scale, resources and “spot on” strategic initiatives they have made in operational improvements, structural cost reductions, brand development, organization, diversification, digitization and related areas. The superior growth has come at a cost, as gross and operating profit margin percentages have shrunk by 130 and 90 basis points, respectively, but operating expenses are 30 basis points lower. This provides ample earnings leverage which will be realized with ongoing volume increases.

As noted by several of the distributor executives during their earnings calls, the foodservice industry, including the “Big 3” and other distributors, is showing remarkable resilience. While the travel and business-oriented segments are facing a slower rebound than other foodservice segments (and distributor exposure to these segments is a definite headwind), restaurants are enjoying an unprecedented demand surge that many are not fully able to handle given the severe labor shortage in certain (many) markets. Distributors have their own labor struggles, and, in some cases, have reduced or eliminated service to specific customers to free up their badly strained capacity, radical approaches rarely seen in other than localized situations. It remains to be seen for how long the problem drags on and how operators respond. Further, the “Big 3” and other foodservice distributors are facing product shortages, poor service levels, late deliveries and a host of other related supply chain problems that pose very serious challenges to their ability to service their customers.

Still, on balance the “Big 3” are reaping the benefits of the industry’s rapid recovery (which is bound to be uneven) and we expect them to continue to do so, given their strong management, ample resources, operational excellence and customer focus.

¹The Chef’s Warehouse, a publicly traded specialty distributor focused on independent restaurants, reported sales +111.0% and gross profit +120.8% on volume trends of +122.9% cases for specialty foods and +66.5% lbs. for center-of-the-plate.

By: Barry Friends | Bob Goldin