Despite solid GDP, employment and wage growth and a sharply lower inflation rate, many foodservice and retail industry participants have recently commented on challenging macro-economic conditions and attribute them, at least in part, to lagging performance. While consumers are facing higher costs in many areas, we think the food and beverage industry softness is due largely to price sensitivity vs. the economy. Notably, food away from home (FAFH) inflation has strongly outpaced its counterpart food at home (FAH) index since February of last year, making it relatively and increasingly more expensive to “dine out” than prepare one’s own meals. The just released July numbers show 4.1% YOY for FAFH vs. 1.0% for FAH, a meaningful, if not deeply troubling gap that is almost certainly influencing consumer behaviors.

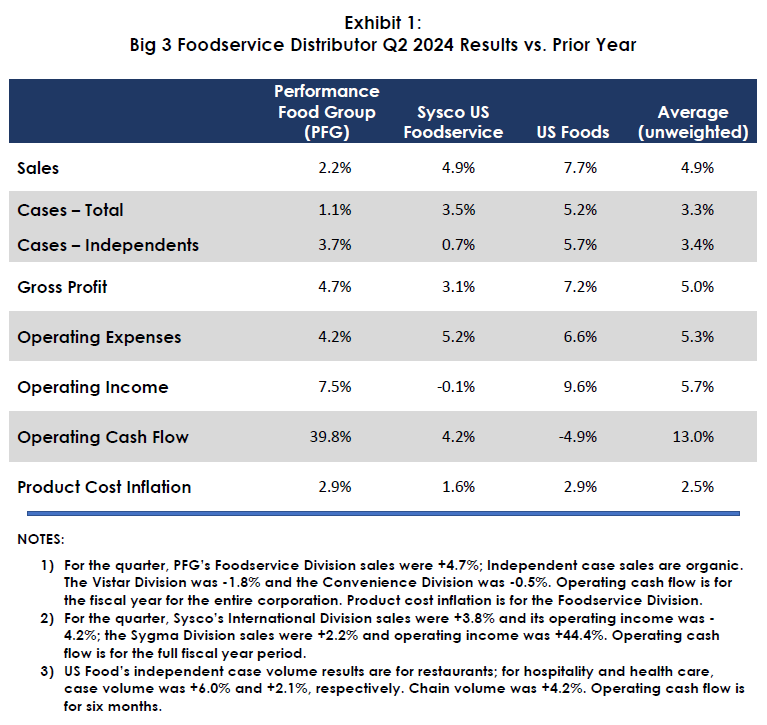

While restaurant sales and traffic are experiencing a decline, the Big 3 foodservice distributors reported strong results for the second quarter of this year, highlighted by case volume growth of 3.3% and gross profit growth of 5.0%1. Notably, as a group, the Big 3 are generating around $4.5 billion per year in operating cash flow, an amount that is increasing as operating income increases. This is enabling them to make acquisitions2, reduce debt, repurchase shares and/or increase dividends.

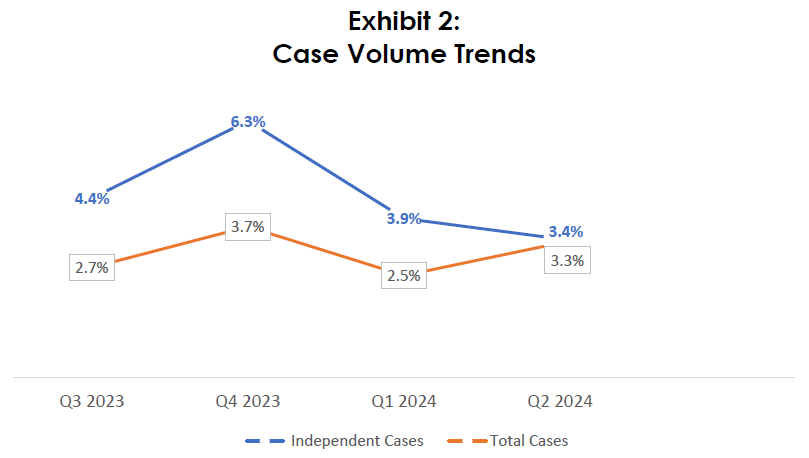

The Big 3 continue to do well in the highly profitable and desirable independent restaurant segment. As illustrated in Exhibit 2, independent case volume has averaged +4.5% over the past four quarters and was +3.4% in the most recent quarter. Executives from the Big 3 each believe they are outperforming that segment of the market and gaining share. Pentallect continues to be a bit baffled as to who the share “losers” are.

Of special note: At its August 14, 2024 earnings call, PFG announced that it plans to acquire Cheney Brothers Inc. (CBI) for $2.1 billion in cash (pending, of course, regulatory approval). CBI is a $3.2 billion broadliner that is heavily concentrated in the Florida market; its customer base skews toward independent restaurants, resorts, country clubs and export sales. It has five facilities that are reported to be “top notch” with capacity for expansion. PFG is paying an admittedly “full” price for CBI but is acquiring a large, growing company in a dynamic market. Among other synergies, PFG said it will focus on increasing its “own brand” sales at CBI. PFG also recently acquired Jose Santiago, the leading broadliner in Puerto Rico. This combination appears to be strategically and tactically prudent and we congratulate PFG on its move.

Looking ahead to the next six to twelve months, we expect the foodservice industry, especially the restaurant segments, to experience ongoing headwinds as consumers reduce frequency and check averages due to high menu prices. A “value war” has begun among many chains and the discounts should stimulate demand, most likely at the expense of (franchisee) margins. This will almost certainly lead to increased trade customer demands for lower prices and increase market competitiveness among distributors. Regardless, the Big 3 are extremely well-positioned to capitalize on a “turbulent” market, as they have been doing. They have winning playbooks and are executing superbly.

By: Bob Goldin and Barry Friends

- Chef’s Warehouse, the other publicly traded “pure play” foodservice distributor focused on “street accounts”, reported an +8.3% sales, +4.0% cases/lbs. and +9.9% gross profit. Latest quarter sales for the company were $955 million. ↩︎

- US Foods completed its acquisition of IWC Food Service, a $200 million broadliner serving the Central Tennessee market, in June 2024. It also announced that it was exploring the sale of its Chef’Store (cash-n-carry) Division to increase focus on its core broadline business. ↩︎