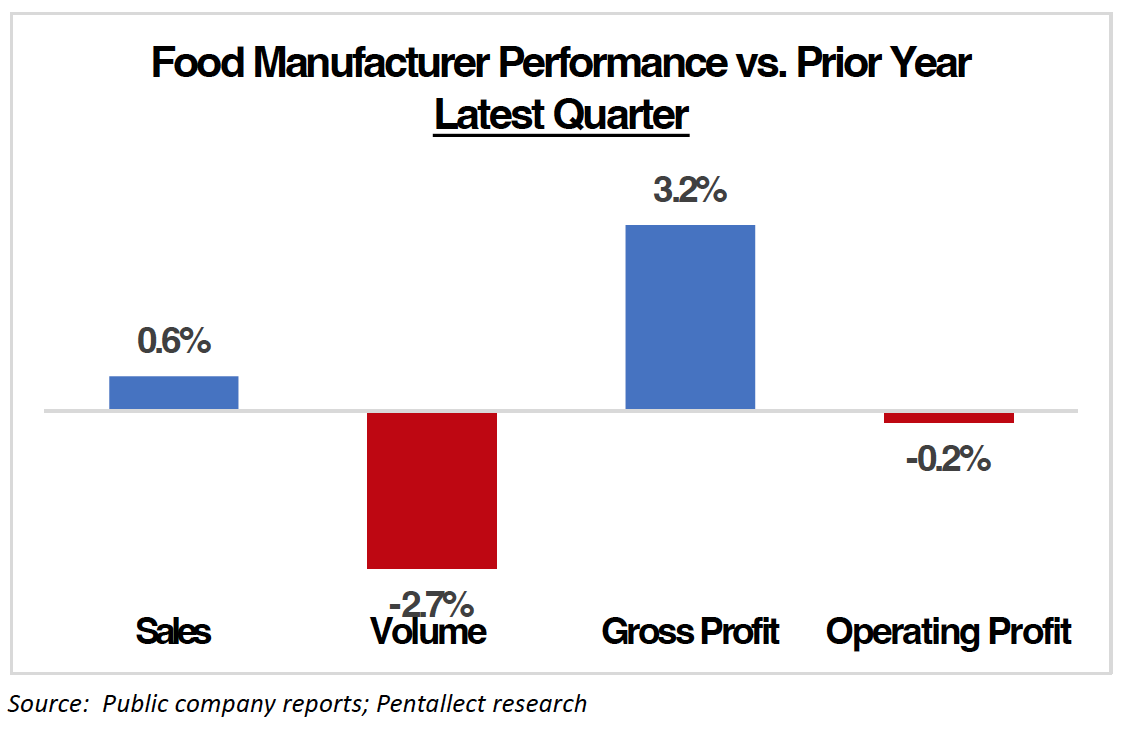

Pentallect has continued to conduct our quarterly analyses of the most recent performance1 of 20 publicly traded, multi-billion-dollar, brand-oriented food and beverage companies. Collectively, the most recent quarterly performance clearly shows that past reliance on price increases to achieve growth is no longer an effective strategy, as revenues were essentially flat across the group and volumes declined for 75% of the reporting companies. Profit performance also highlights a troubling trend, as gross profit increased an average of 3.2% while operating profit declined -0.2%; a significant shift from last quarter when both profit metrics delivered double-digit growth versus the prior year. If volume declines continue, additional profit erosion is to be expected. This erosion will lead to cost cutting, portfolio restructuring, a likely adverse investor reaction and other negative consequences.

We believe there are several reasons why this troubling volume situation is occurring:

- Evolving Consumer Behavior: Higher prices, especially within the retail channels, are forcing consumers to alter their purchasing behavior, resulting in share gains for private label products as well as more private-brand oriented retailers (Aldi, Costco, Trader Joe’s, etc.) where the reporting companies generally do not have as large a presence. It appears as if food and beverage companies have underestimated consumers’ price elasticity.

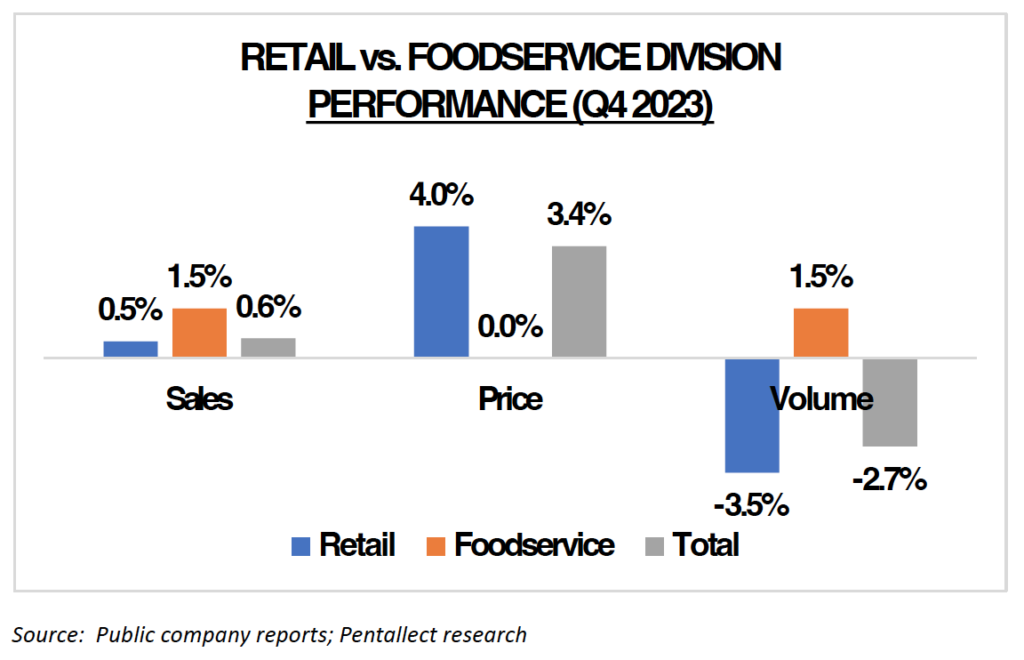

- Channel Shifts: Continuing a trend over the past year, foodservice business units outperformed retail within all of the companies that report results for both units, indicating that retail business units have generally struggled to maintain their value propositions relative to their foodservice counterparts. This foodservice channel momentum is underscored by strong foodservice distributor performance, as noted in our recent Pentallect POV and is confirmed by input received by Pentallect.

Over the past quarter, the reporting foodservice businesses have maintained stable pricing versus prior year, while their retail counterparts continued to employ higher prices. We believe that this pricing dynamic, combined with the traditional foodservice channel benefits of convenience and experience, has tipped the scale for consumers and they are responding by allocating a greater share of their food dollars to the foodservice channel.

- Lack of Innovation: Rather than innovating, most food and beverage manufacturers have been overly reliant on taking price increases to drive top-line growth and manage costs. Moving forward, these companies must deliver both compelling new products and employ revised pricing strategies, including a return to strategic promotional activity, to increase demand; both of which declined during the pandemic recovery period.

Consumers (and the trade), particularly in retail channels, are sending a clear message that they are fed up with higher prices and are acting accordingly. After stabilizing supply chains, streamlining assortment and improving margins post-pandemic, now is the time for food and beverage manufacturers to focus on demand creation to regain positive volume trajectories.

By: Bob Goldin and Rob Veidenheimer

Please join us at our upcoming webinar: The Pricing Party Is Over at 1:00pm eastern on Tuesday, March 19th to discuss the latest food industry sales, volume, pricing and margin trends. The webinar will discuss shifting channel dynamics, implications and imperatives for industry participants given ongoing overall volume declines. Please use this link to register for the webinar.

- The results are for the most recent quarter and include acquisitions/divestitures, foreign currency gains/losses, and restructuring/impairment charges. ↩︎