By: Barry Friends | Gary Karp

May 28, 2020

There are many projections of what the size and structure of the foodservice industry will be as we emerge from the March-April-May restrictions and how long it will take for foodservice to establish new sales structures and volume baselines.

Due to the impacts of the pandemic, a large percentage of foodservice operators, distributors, GPOs and manufacturers see the need and/or opportunity to reengineer their business models and processes for post-pandemic FS 2020 and beyond. Trade spending* should be on the list for improving/re-engineering.

Situation: Trade spending is a very important component of trading partner operations.

Prior to Covid-19, manufacturer trade spending was:

- the second highest P&L cost for manufacturers (after cost of goods),

- a primary income source for GPOs,

- a primary source of discounts for operators,

- and a significant component of profitability for distributors.

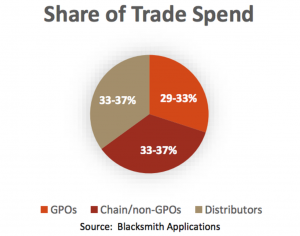

2019 manufacturer trade spend share:

Trade spending in foodservice is and has been highly complex and includes a wide variety of trading partner strategies, tactics, structures, rates, competitive activities, contractual agreements and administrative challenges. For example, some manufacturer programs are “fixed amount/lump sum” programs while others are based on rate x sales = spend; many operator programs are deviated pricing; double-dipping is difficult to track/stop, etc.

Currently, as foodservice trading partners navigate through the industry disruption, many report that reengineering their trade spending has been assigned a “lower sense of urgency” relative to crisis/survival management (such as identifying new sources of business, issues with sales, HR, production, inventory, credit terms and supply chain).

Industry Changes impacting and warranting trade spending improvement or re-engineering:

Given the importance of trade spending to each trading partner and the likely changes to the foodservice industry, trade spending now appears due for a thoughtful re-evaluation of strategies and processes. Key industry changes driving the need include:

- Lower industry volumes: due to FS operator bankruptcies or the permanent closure of many independent FS operators and chain units

- Lower operator volumes due to operating restrictions and mandated capacity constraints

- Slow or modified return to common workplaces, schools, colleges and sporting events

- Shrinking of the traditional manufacturer, GPO, and distributor profit pools as the population of independent operators is reduced

- Simplification of restaurant menus/potential SKU elimination

- Closures of distributors in some markets

- Line structure simplification and SKU rationalizations across trading partners

- Operator share shift to more chain/contract business (contract volume prior to Covid-19 was approaching 70%, with independent operators being the largest cohort of purchasers on “street” pricing)

- Shifting marketplace leverage (push – pull) which will impact brand shares

- Reduced consumer spending (due to lower consumer confidence and disposable personal income) will be a drag on restaurant recovery

Each of the above factors points to reduced volumes and smaller trading partner profit pools.

Considerations:

As you analyze your trade spending, the overarching question is: “In light of the substantial changes to the industry, the industry financials, the trading partners, and potentially the competition, how much improvement and re-engineering can and should be done?”

Some suggested tasks that should be incorporated in a review:

- Update trade spend objectives, strategies and tactics, incorporating new economic realities.

- Analyze how trade spend was performing (ROI, effectiveness) prior to Covid-19.

- Review and update what you are hoping to achieve with trade spending going forward (ROI, category performance, volume and brand growth, account penetration, etc.).

- Address weaknesses (ex: double-dipping, competitiveness, inability to analyze data etc.).

- ID how to take further advantage of continually improving TPM technology, data analytics, and consider tools that are needed to do so.

- Assess and incorporate specifics of your marketplace leverage (ex: push-pull, brand strength, sales resources and competitive strengths and weaknesses).

- Ensure a clear understanding of all current contractual obligations and terms of each contract.

Additional thoughts and recommendations:

- Changes should be data-driven, strategic, and easy to explain internally and externally.

- Collaborate: Build trust with internal and external constituents.

- Simplify programs so they are easier to understand, manage and achieve success.

- Build negotiation skills for trade spending and beyond.

- Increase use of technology: TPM tools have substantially increased functionality

Final Comment: Any changes to trade spend, unless clearly justified, will create pushback. Implementation of changes will require “courage of conviction”. Therefore, each in-depth process should be bold, rigorous, well founded and highly strategic.

*Note:

Pentallect defines foodservice trade spend as amounts paid by manufacturers to operator, GPO and distributor customers inclusive of:

- Price deviations

- Rebates and allowances for guaranteed and performance-based programs

- Other marketing funds excluded from this definition are temporary price reductions (TPRs), sampling allowances, and DSR spiffs

Trade spend is expressed as a percent of net sales, as defined below:

Gross sales less TPRs, Cash discounts = Net sales

Net sales less Costs of goods sold (COGs) Cash discounts = Gross margin

Gross margin less Trade spending, Go to market operating costs = Net profit

Pentallect is well-versed and prepared to assist in the re-engineering of your post-pandemic business models and processes, including trade spend review, modification and improvement, to optimize net profit.