by: Barry Friends | Bob Goldin

May 14, 2018

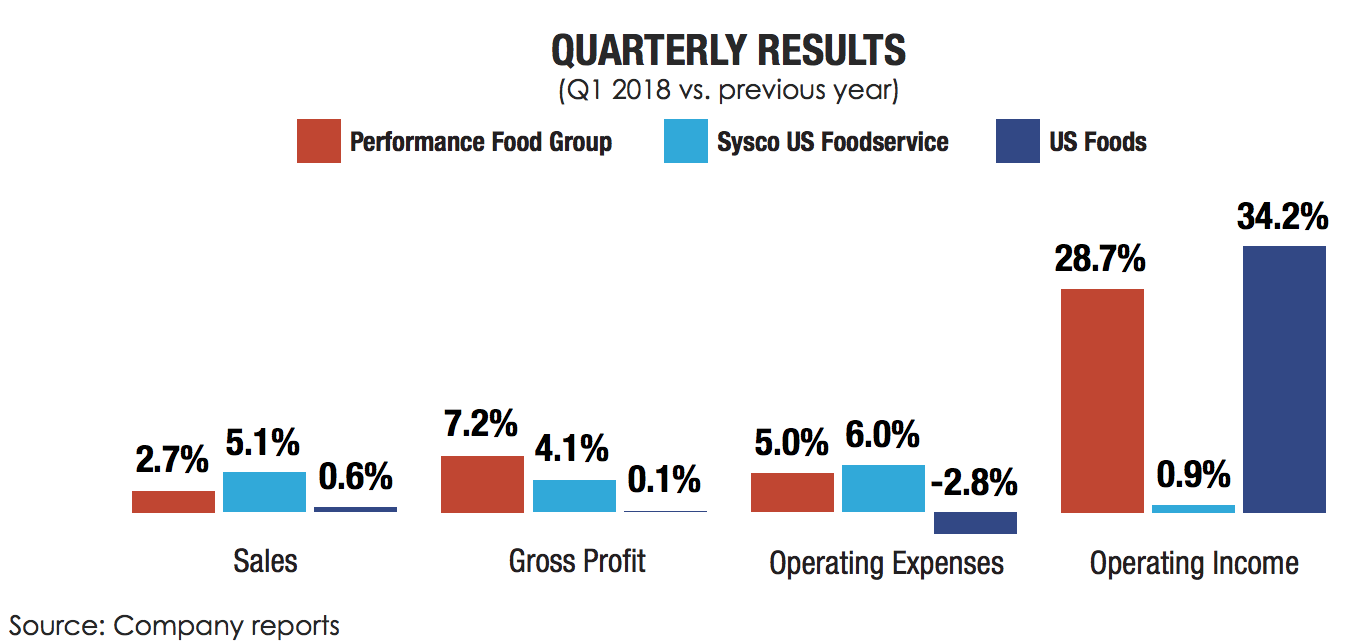

As residents of cold weather climates (Chicago and Minneapolis), the writers are all too aware of the dampening effects adverse winter weather can have on consumer behavior and of the mobility restrictions it imposes. As we know, this past winter was unusually harsh (and 2017, mild), negatively impacting the results of the public Big 3 distributors (Performance Food Group, Sysco, and US Foods). Despite the record cold and snowstorms and cost headwinds from 2 – 3% food cost inflation and freight, the three companies reported solid quarterly and year-to-date results. The results reflect ongoing improvements in product and customer mix, expense control and positive returns on strategic investments. All three companies continue to report strong growth in their private brand sales, which is clearly a major profit driver.

As residents of cold weather climates (Chicago and Minneapolis), the writers are all too aware of the dampening effects adverse winter weather can have on consumer behavior and of the mobility restrictions it imposes. As we know, this past winter was unusually harsh (and 2017, mild), negatively impacting the results of the public Big 3 distributors (Performance Food Group, Sysco, and US Foods). Despite the record cold and snowstorms and cost headwinds from 2 – 3% food cost inflation and freight, the three companies reported solid quarterly and year-to-date results. The results reflect ongoing improvements in product and customer mix, expense control and positive returns on strategic investments. All three companies continue to report strong growth in their private brand sales, which is clearly a major profit driver.

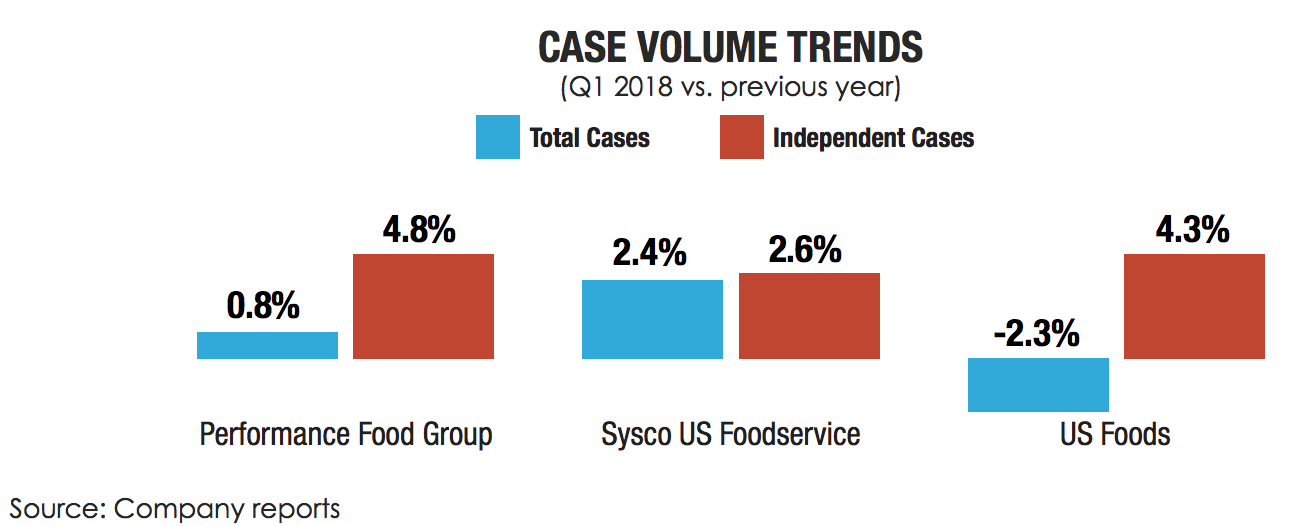

Given their growth and profitability, independent restaurants are a market “sweet spot.” For each of the three distributors, case volume growth of the independent restaurant segment substantially exceeds the case volume growth of other segments. The growth of this strategically important segment among the three largest broadline distributors indicates underlying strength and dynamism of independent restaurants; it also indicates effective targeting and top-notch execution by the referenced distributors.

In addition to solid performance by their broadline divisions, both Sysco and Performance Food Group are benefitting by their diversification. Sysco’s international division represents 19.5% of total company sales and accounts for 32.8% of sales growth. It grew nearly 11% last quarter and profitability is improving. Vistar, the leading candy/snack/vending specialty distributor, is an increasingly important contributor to Performance Food Group’s sales and profit growth. It is the company’s fastest growing and highest margin division. It currently represents 19% of total company sales and experienced 9.3% sales and 14.0% profit growth last quarter. All three companies affirmed positive outlooks for the balance of this year, with expectations of sequential improvement over the tough first quarter. We expect the companies to “double down” on their current winning strategies and to gain valuable share of the domestic and, in the case of Sysco, global foodservice distribution market.