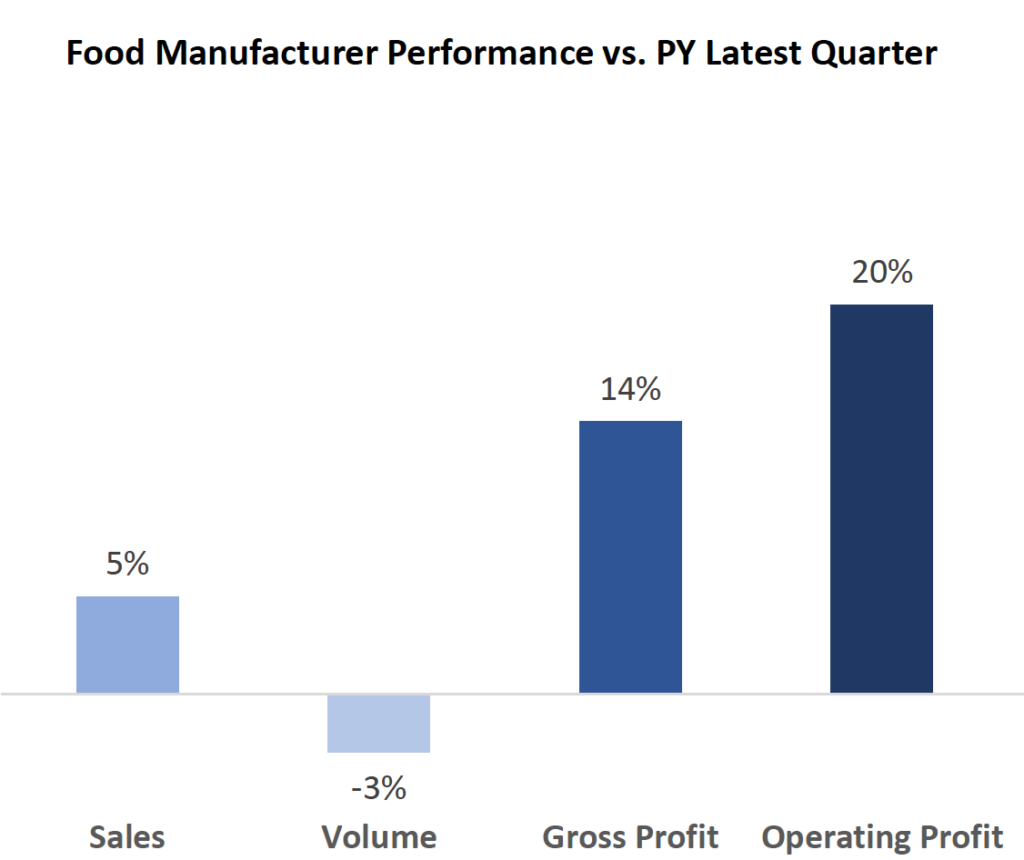

Pentallect has compiled and analyzed the most recent quarterly performance1 of 20 publicly traded, multi-billion-dollar, brand-oriented food and beverage companies. While the studied companies achieved solid growth in sales and profitability, their volume declined at a 3% rate; only three of the 20 companies (15%) had a volume increase. These results are consistent with longer term trends, as food and beverage company volumes have largely lagged pre-Covid levels while sales and profitability have generally surpassed 2019 performance due primarily to pricing actions.

We believe there are several reasons why this troubling volume situation is occurring:

- Due to inflation and other factors, food and beverage manufacturers have raised their prices considerably over the past several years. The price increases have served to protect and, in many cases, boost their margins. For a variety of reasons, consumers are increasingly pushing back on premium priced foods and beverages and trading down to lower priced alternatives, including value-oriented channels and operators/retailers. Given this dynamic, achieving any margin accretive mix improvement and/or taking further price advances is and will be a major challenge.

- To bolster profitability – and probably underestimating consumer price elasticity – manufacturers have been reluctant to promote their brands, which has almost certainly contributed to the volume erosion.

- During Covid, manufacturers focused on product availability and other supply chain issues at the expense of innovation and consumer demand creation programs and are likely finding it difficult to ramp up these initiatives.

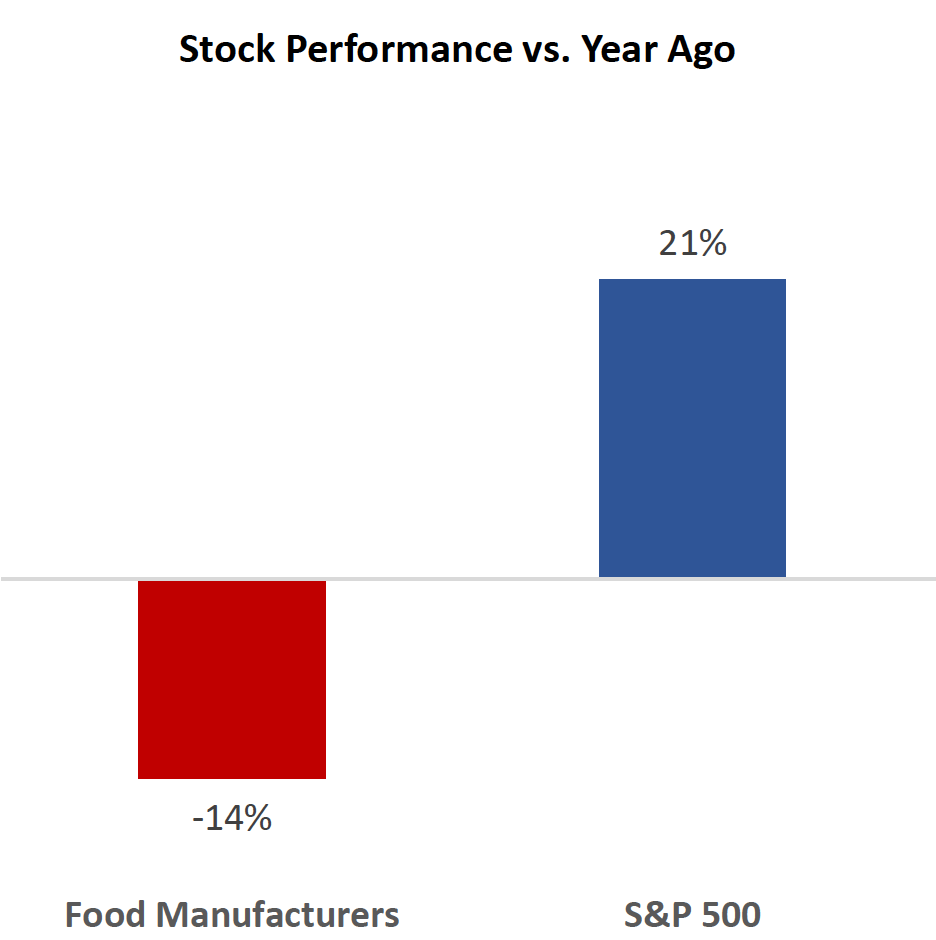

As illustrated below, the performance of the stocks of these 20 companies is down considerably (-14%) while the broader S & P 500 is +21%. It is fairly evident that the market is concerned with the status and outlook for food and beverage companies, which are traditionally regarded as “safe and steady” performers.

In light of ongoing volume softness, consumer resistance to high prices, and improved corporate profitability, food and beverage companies must pivot to heavier investment in demand creation activities and innovation or risk share loss in this operating environment.

- The results are for the most recent quarter and include acquisitions/divestitures, foreign currency gains/losses, and restructuring/impairment charges. Stock market data are as of October 12, 2023 ↩︎

By: Bob Goldin and Rob Veidenheimer

– Join us for our upcoming Summit –

Foodservice Distribution: What’s Next?

Chicago, Illinois